In the rapidly evolving landscape of blockchain interoperability, cross-chain bridges have become indispensable infrastructure, facilitating seamless asset and data transfers across networks. Yet as of late 2025, these very bridges represent the single largest attack surface in Web3, over $2.5 billion has been siphoned from bridge exploits, more than any other DeFi category. At the heart of these vulnerabilities lies a critical architectural flaw: centralized validator sets.

Centralized Validators: The Billion-Dollar Single Point of Failure

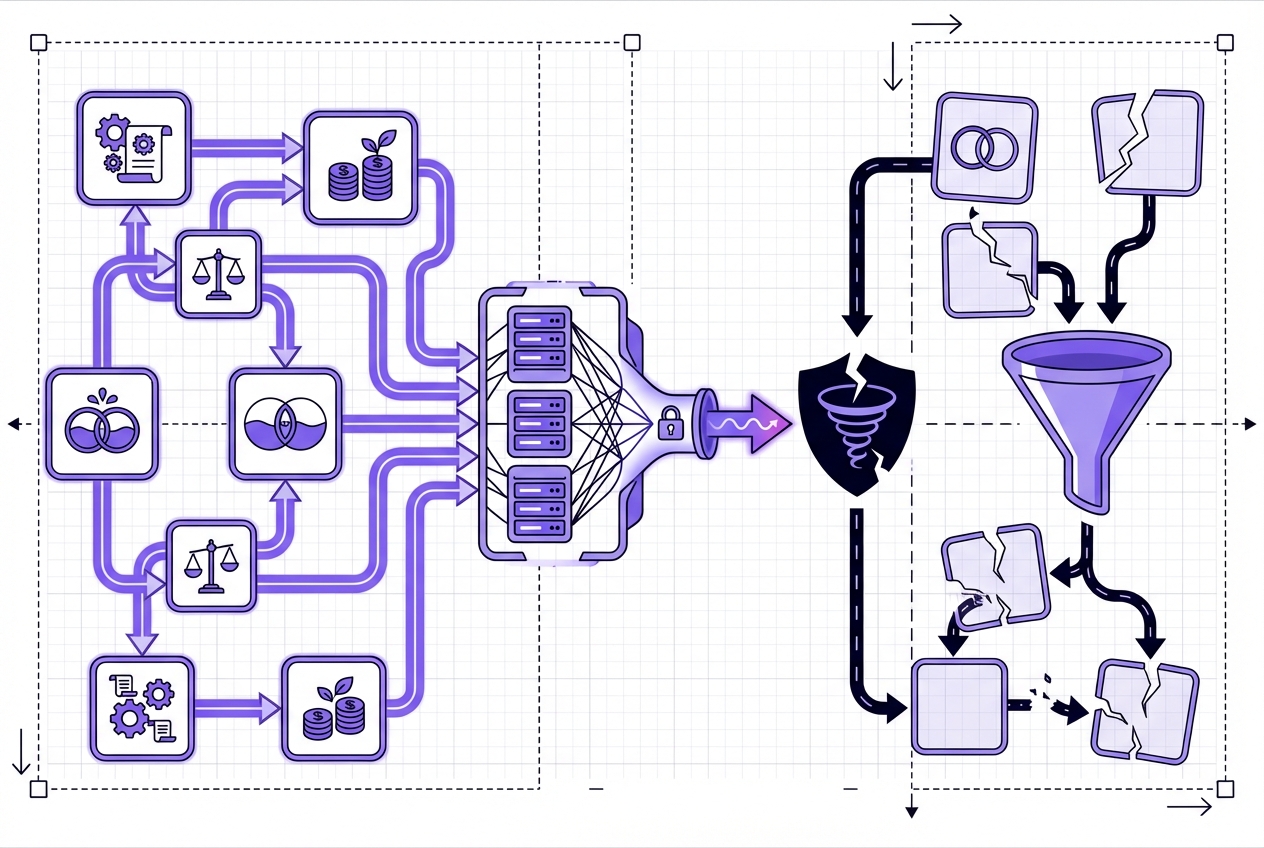

A cross-chain bridge typically relies on a set of validators, entities responsible for confirming transactions and maintaining the bridge’s operational integrity. When this set is small or controlled by a handful of parties, it creates a classic single point of failure. Attackers need only compromise a majority (sometimes as few as 3-5 keys) to seize control over billions in locked assets.

The infamous Ronin Network hack in 2022 remains the textbook case: attackers gained access to five out of nine validator keys and drained $625 million in seconds. Fast forward to 2025, with $55 billion total value locked (TVL) across bridges, and the stakes have multiplied. This isn’t theoretical, the threat is live, ongoing, and growing more sophisticated each quarter. For an in-depth look at how validator centralization exposes bridges to catastrophic exploits, see this technical breakdown.

How Centralization Amplifies Attack Vectors

- Key Compromise Risk: With fewer validators, each private key becomes a high-value target. Social engineering and phishing attacks are increasingly tailored to exploit human error or weak key management practices.

- Lack of Transparency: Centralized validator sets often operate behind closed doors, limiting public auditability and slowing response times during incidents.

- Collusion and Insider Threats: When trust is concentrated among a select few entities, sometimes even under one organizational umbrella, the risk of collusion or insider malfeasance skyrockets.

This concentration not only increases the likelihood of successful attacks but also means that when breaches occur, they are devastatingly efficient, funds can be drained before teams can even detect abnormal activity. As outlined by Chainlink’s recent research on cross-chain vulnerabilities, centralized validator sets are often the weakest link in otherwise robust protocols.

Real-World Impact: Billions Lost and Ecosystem Trust Shaken

The numbers speak for themselves: hacks targeting centralized bridge validators have accounted for over half of all DeFi losses since 2021. Inadequate key management remains a recurring theme; compromised private keys allow attackers to mint synthetic assets or drain liquidity pools without resistance. For example:

- $625 million Ronin Bridge exploit (2022): Five out of nine validators compromised via social engineering.

- $320 million Wormhole hack (2022): Exploited smart contract bug paired with centralized guardianship model.

- $190 million Nomad Bridge breach (2023): Validator misconfiguration led to open access for attackers.

This isn’t just about lost funds, it’s about shattered user confidence and systemic risk that ripples through every integrated protocol. According to Mitosis University’s latest analysis on cross-chain bridge security in 2025, centralization risks remain the most persistent threat vector despite advances in smart contract auditing and formal verification.

Toward Mitigation: Decentralization Isn’t Optional Anymore

The lesson is clear: robust cross-chain security demands decentralization at every layer, not just consensus but also key management and operational monitoring. Expanding validator sets dilutes control among diverse actors, making collusion exponentially harder and attacks less likely to succeed undetected. For practical strategies on moving toward more decentralized architectures, including multi-sig schemes and hardware security modules, see our guide on improving cross-chain bridge security with decentralized validators.

But decentralization is only as strong as its weakest link. Simply increasing the number of validators without upgrading operational security, transparency, and monitoring can create a false sense of safety. Attackers are adaptive: as validator sets grow, so do the sophistication and coordination of exploits. That’s why leading protocols in 2025 are combining decentralized validators with real-time anomaly detection, comprehensive audit trails, and layered access controls.

Modern Best Practices: Checklist for Bridge Security in 2025

Security-forward teams are now adopting a multi-pronged approach:

- Validator Diversity: Onboard geographically and institutionally diverse validators to reduce collusion risk.

- Multi-Signature and MPC: Use threshold cryptography so no single key or entity can unilaterally control funds.

- Hardware Security Modules (HSMs): Store validator keys in tamper-resistant environments to thwart physical and remote attacks.

- Continuous Monitoring: Deploy real-time analytics to flag suspicious transactions or validator behavior before losses escalate.

- Transparent Governance: Make validator set changes and incident responses auditable by the community to build trust.

The evolution toward these standards is not just technical, it’s cultural. The DeFi community is demanding more transparency, accountability, and open-source validation at every level of bridge operation. For a deeper dive into how trust assumptions in bridge design create hidden risks, see our analysis on multisig and MPC vulnerabilities.

What’s Next: The Roadmap for Trustless Interoperability

The future of cross-chain messaging risk analysis will hinge on continuous innovation, both in cryptography and protocol governance. Emerging solutions like zero-knowledge proofs for bridge attestations, decentralized watchtower networks, and automated circuit breakers are already shifting the security paradigm. As TVL across bridges continues to rise (now at $55 billion), the cost of complacency grows ever steeper.

If you’re building or integrating with a cross-chain bridge in 2025, prioritize decentralization not as an ideal but as a baseline requirement. Regularly audit your validator set composition, incident response plan, and key management stack. The next billion-dollar exploit won’t wait for you to catch up.

The bottom line? Cross-chain bridges remain both the engine and Achilles’ heel of Web3 interoperability. By learning from past failures, and rigorously applying decentralized best practices, we can transform them from hacker honeypots into resilient infrastructure worthy of tomorrow’s digital economy.