Cross-chain bridges have become the lifeblood of decentralized finance, enabling seamless movement of assets and data between blockchain networks. Yet, as these protocols scale to support more value and users, their security risks multiply, especially when it comes to signature verification. A single lapse in validating signatures can open the floodgates to unlimited token minting, devastating both users and protocols.

How Cross-Chain Bridges Facilitate Token Transfers, and Where Things Go Wrong

At their core, cross-chain bridges work by locking assets on one blockchain and minting equivalent tokens (often called wrapped tokens) on another. This process hinges on trustless smart contracts and robust cryptographic proofs. However, if the signature checks meant to authorize these actions are flawed or can be bypassed, attackers can mint tokens without actually locking any assets, effectively creating value out of thin air.

This isn’t just a theoretical concern. According to recent analysis from Chainlink and Officer’s Notes, bridge signature bypass vulnerabilities remain among the most severe threats facing DeFi today. Attackers exploit bugs in smart contract logic or weaknesses in multi-signature schemes to forge transactions that look legitimate but actually circumvent intended controls.

The Anatomy of a Bridge Signature Bypass Vulnerability

Signature bypass vulnerabilities typically exploit flaws in how smart contracts verify transaction approvals across chains. Here’s how these exploits often unfold:

- Poor Input Validation: If a contract fails to rigorously check all transaction parameters or signatures, an attacker may pass crafted data that tricks the contract into treating forged signatures as valid.

- Ecrecover Exploits: Some bridges use Ethereum’s

ecrecoverfunction for signature recovery but implement it incorrectly, allowing attackers to replay or forge approvals. - Compromised Validator Keys: In multi-signature setups, stealing or duplicating enough validator keys lets attackers sign off on fraudulent mints.

- Countersigning Logic Bugs: If the logic that requires multiple independent approvals is faulty, for example, by not checking for duplicate signers, an attacker could use the same key multiple times.

The impact? Unlimited token minting with no underlying collateralization, a risk that has already manifested in some of DeFi’s largest hacks.

Case Studies: When Signature Bypasses Led to Massive Losses

The past few years have seen several high-profile incidents where bridge signature bypasses resulted in catastrophic losses:

- The Wormhole Bridge Exploit (2022): Attackers exploited improper signature checks in Wormhole’s Solana-Ethereum bridge, minting $120,000 wETH out of thin air by forging validation proofs. The incident rocked confidence in cross-chain solutions and forced emergency intervention.

- The Binance Bridge Attack (2022): Through forged cryptographic proofs and weak validation logic, hackers withdrew approximately $566 million from Binance Smart Chain’s bridge, one of the largest DeFi exploits ever recorded.

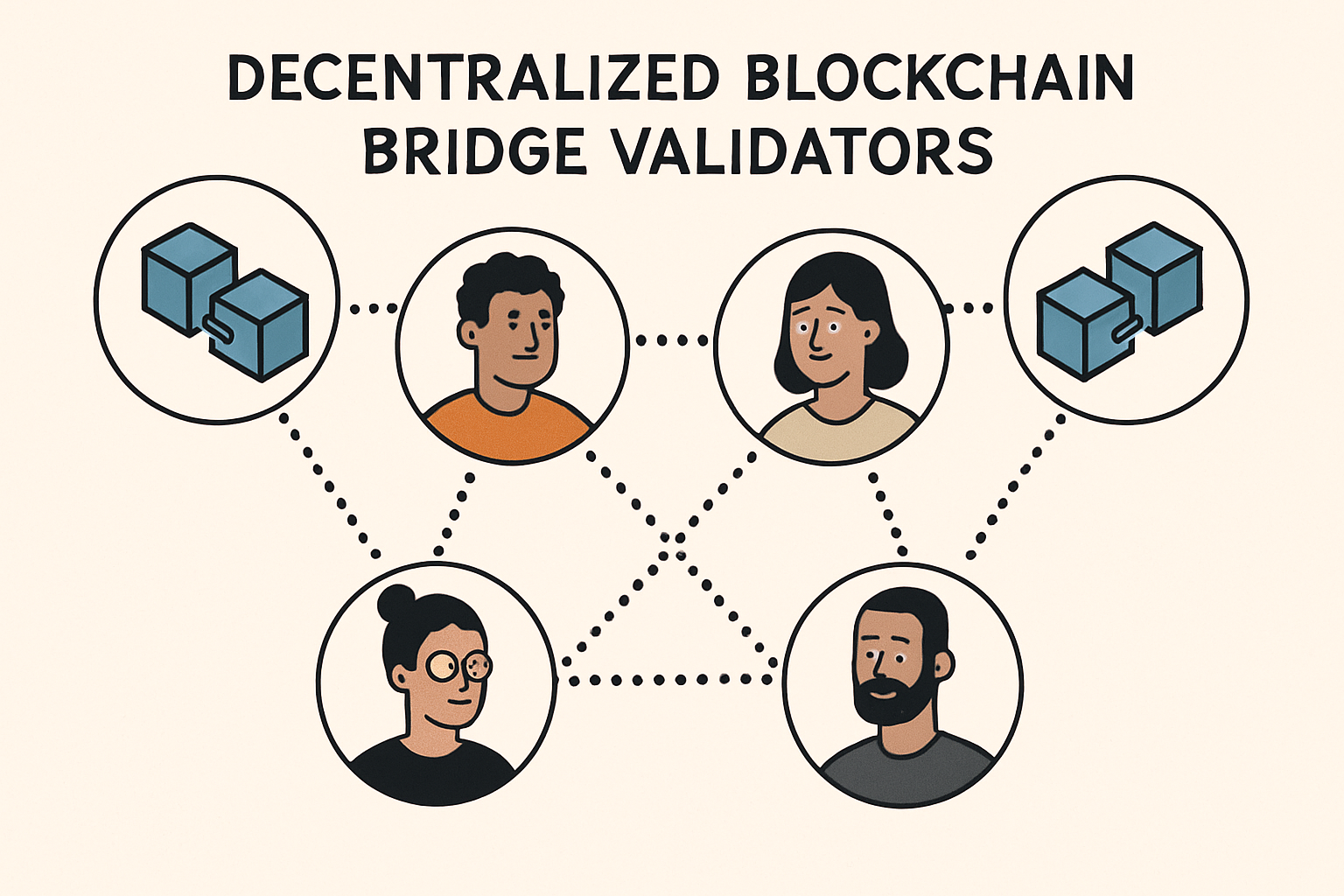

- The Harmony Horizon Bridge Breach (2022): By compromising two validator keys in a 2-of-4 multi-signature scheme, attackers approved unauthorized transactions totaling around $100 million. This highlighted the dangers of insufficiently decentralized validation mechanisms and weak key management practices.

If you want an even deeper dive into why cross-chain bridges are such a persistent security risk, and how real-world exploits unfold, I recommend reading our comprehensive analysis at this resource.

These real-world exploits underscore a sobering truth: bridge signature bypass vulnerabilities are not rare edge cases. They are recurring, systemic risks that can undermine the very trust that cross-chain protocols are built upon. When attackers successfully mint tokens without actual asset backing, the knock-on effects ripple across connected ecosystems, causing price distortions, liquidity crises, and often irreparable reputational damage for both the protocol and its users.

Mitigation: Strengthening Bridge Security in 2025 and Beyond

The good news is that the industry has learned from past failures and is actively working to shore up defenses against these exploits. Here are some of the most effective mitigation strategies being adopted:

Top Bridge Security Best Practices to Prevent Signature Bypass

-

Comprehensive Smart Contract Audits: Engage reputable security firms like ConsenSys Diligence or Trail of Bits to regularly audit bridge smart contracts for vulnerabilities, especially in signature verification logic.

-

Robust Signature Verification: Implement advanced cryptographic standards such as ECDSA and EdDSA, and ensure all input data is rigorously validated to prevent forged signatures.

-

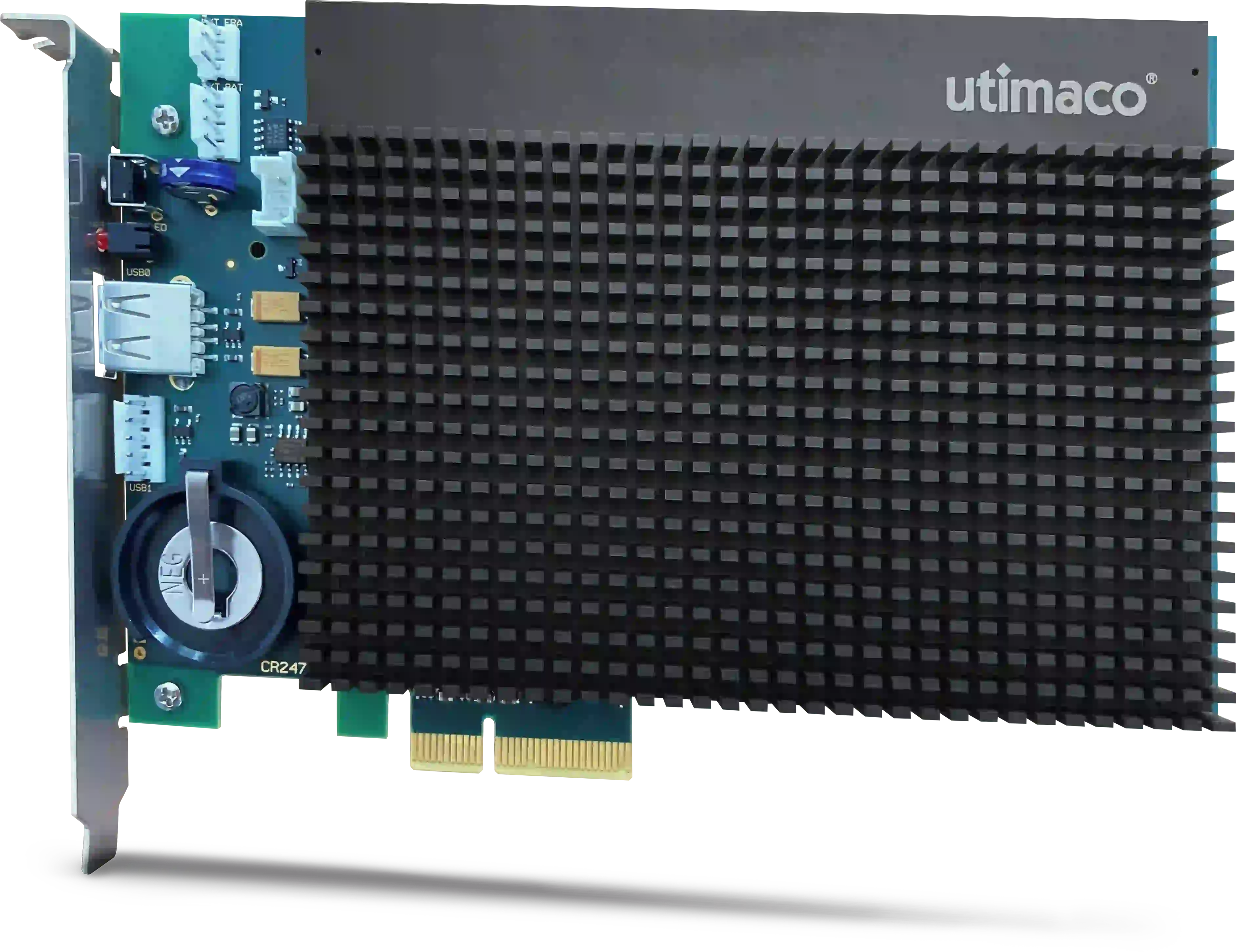

Secure Validator Key Management: Use hardware security modules (HSMs) and multi-party computation (MPC) wallets to safeguard validator private keys and reduce the risk of compromise.

-

Decentralized Validation Mechanisms: Increase the number and diversity of validators using protocols like Chainlink CCIP or Axelar Network to minimize single points of failure and resist validator collusion.

-

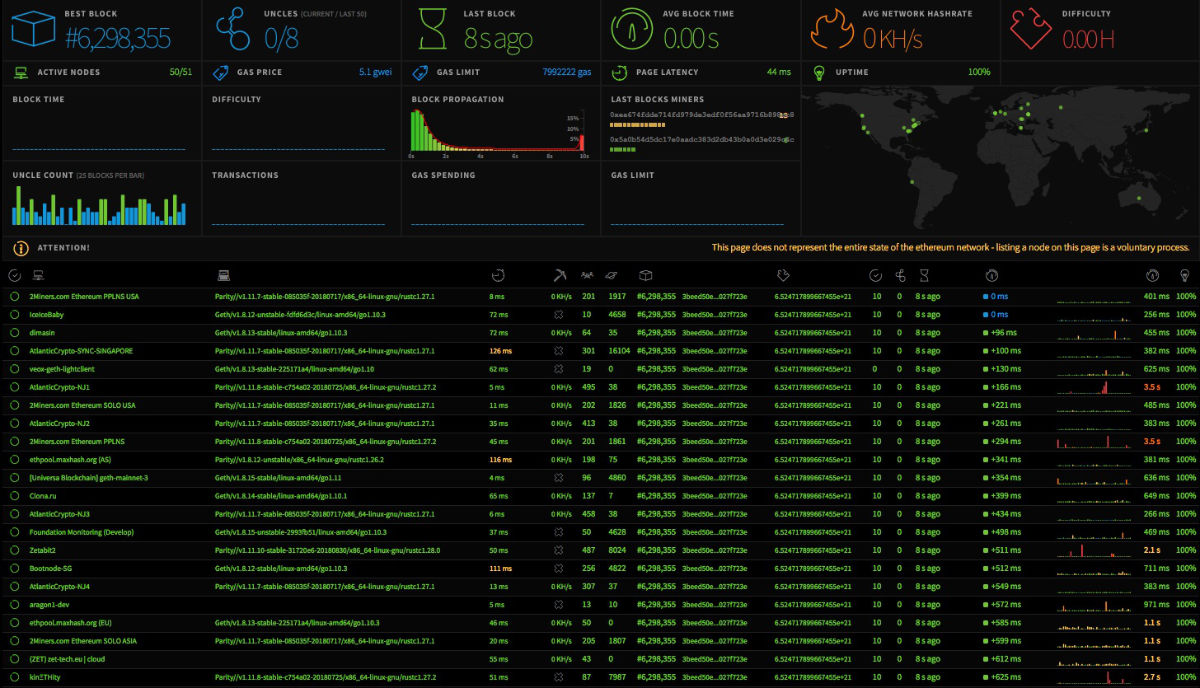

Continuous Monitoring & Incident Response: Deploy real-time monitoring solutions such as CertiK Skyfall or HAL for anomaly detection and rapid breach response.

1. Comprehensive Smart Contract Audits: Regular, independent code reviews help catch subtle bugs in signature validation logic before they can be exploited. Many leading bridges now mandate third-party audits prior to mainnet launches or major upgrades.

2. Enhanced Signature Verification: Protocols are moving beyond basic ecrecover-based schemes, implementing multi-factor cryptographic checks and stricter input validation to ensure only legitimate signatures authorize minting events.

3. Secure Key Management: The use of hardware security modules (HSMs), threshold signatures, and multi-party computation (MPC) greatly reduces the risk of validator key compromise, a root cause in several headline hacks.

4. Decentralized Validation Mechanisms: By increasing the number of independent validators and requiring higher quorum thresholds for transaction approval, bridges become more resilient to targeted attacks on individual keys or nodes.

Practical Steps for Protocol Teams and Users

If you’re building or interacting with cross-chain protocols, consider these practical steps:

- Monitor audit reports from reputable security firms before using any bridge.

- Avoid bridges with centralized validator sets, as these are more susceptible to key compromise attacks.

- Stay updated on known vulnerabilities by following open-source trackers like Bridge-Bug-Tracker on GitHub.

- Diversify your exposure: Don’t keep all assets on a single bridge or wrapped token.

The Road Ahead: Building Trust in Cross-Chain Interoperability

The future of DeFi relies on secure interoperability between blockchains. As we’ve seen, even a single unchecked vulnerability, like a bridge signature bypass, can have outsized consequences. But with diligent code review, robust cryptographic design, decentralized validation, and transparent disclosure practices, it’s possible to dramatically reduce these risks.

The next generation of cross-chain protocols will be defined by their ability to anticipate attackers’ moves and proactively close off potential vectors like unlimited token minting exploits. For investors and builders alike, understanding the anatomy of these vulnerabilities is essential for making informed decisions and contributing to a safer ecosystem.

If you’d like to explore more about why cross-chain bridges remain one of DeFi’s biggest security challenges, and what’s being done about it, visit our deep-dive analysis at this page.