Cross-chain messaging is quickly becoming the backbone of blockchain interoperability. As DeFi and institutional capital pour into multi-chain ecosystems, trust in these messaging platforms is more crucial than ever. But how do you know if a cross-chain protocol truly deserves your confidence? It all comes down to a handful of critical, measurable metrics. Let’s break down the three most important indicators for evaluating trustworthiness: Bridge Contract Immutability Score, Cross-Chain Message Finality Time, and On-Chain Slashing/Dispute Resolution Coverage.

Bridge Contract Immutability Score: The Foundation of Trust

Immutability isn’t just a buzzword, it’s the bedrock of protocol security. The Bridge Contract Immutability Score measures how resistant a bridge’s core contracts are to unauthorized changes or upgrades once deployed on-chain. Why does this matter? Because every tweakable contract variable or upgradable proxy is a potential attack vector that could be exploited by insiders or hackers. High immutability scores mean fewer moving parts and less risk of rug pulls or backdoor exploits.

Leading protocols are now getting their contracts audited for upgrade safety and publishing transparency reports. Some even use formal verification techniques to mathematically prove key functions can’t be tampered with post-deployment. If you’re evaluating a cross-chain bridge, demand clear documentation on its immutability guarantees, and check its score before trusting your assets.

“Immutability is not just about code, it’s about aligning incentives and removing single points of failure from the system. “

Cross-Chain Message Finality Time: Speed Meets Security

No one wants to wait forever for their assets or data to arrive safely on another chain, but speed alone isn’t enough. The Cross-Chain Message Finality Time quantifies how long it takes for a message (or asset transfer) to be considered irreversible across chains. This metric directly impacts user experience and security:

- Shorter finality times: Smoother UX, but potentially higher risk if not paired with robust consensus mechanisms.

- Longer finality times: More time for dispute resolution, but could frustrate users or traders seeking fast execution.

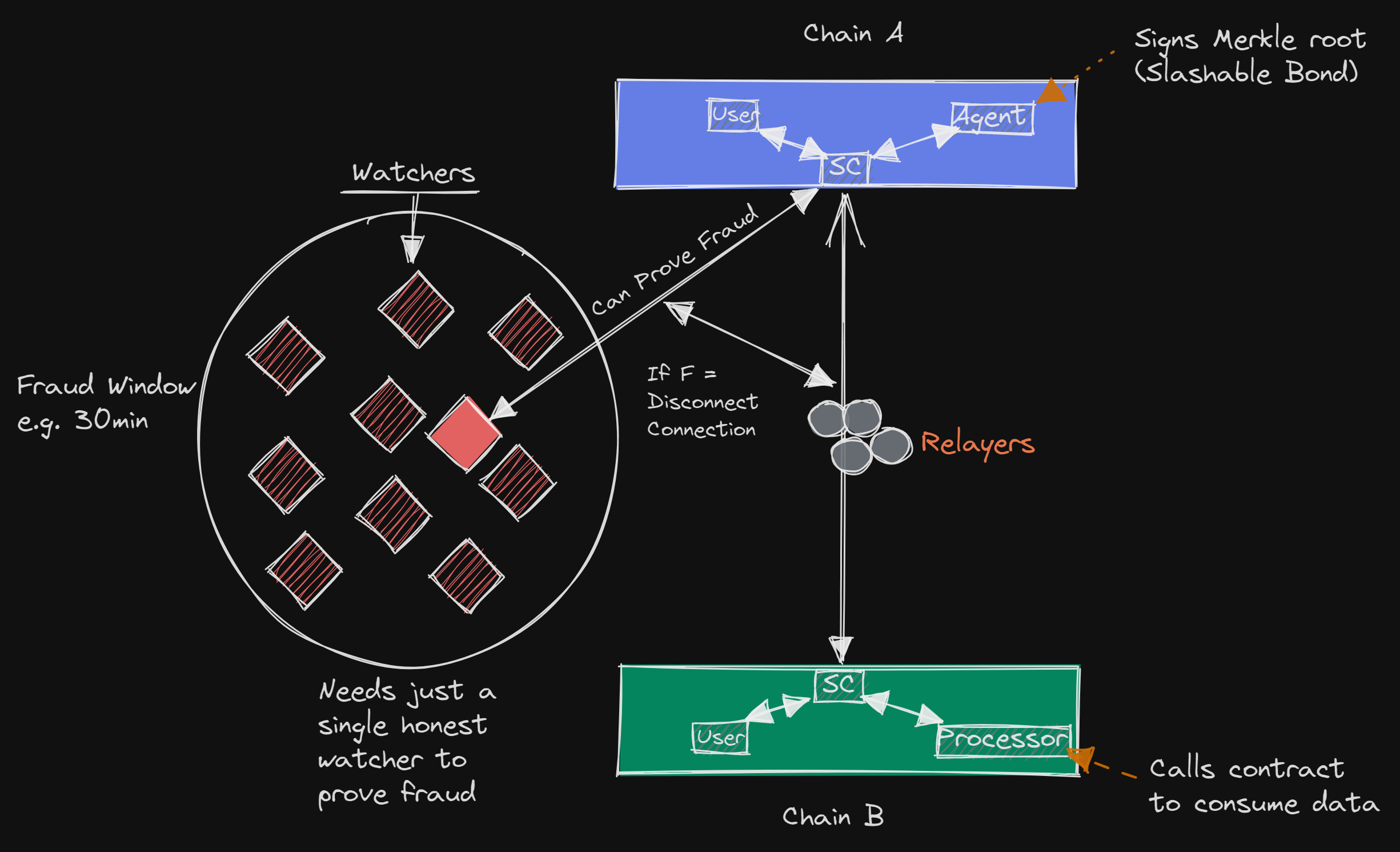

The best platforms strike a balance by using decentralized relayers, cryptographic proofs (like zero-knowledge proofs), and transparent monitoring tools that let users verify finality status in real time. If you’re serious about minimizing counterparty risk while keeping things snappy, scrutinize this metric closely when comparing bridges.

On-Chain Slashing/Dispute Resolution Coverage: Accountability in Action

No system is perfect, so what happens when something goes wrong? That’s where On-Chain Slashing/Dispute Resolution Coverage comes in. This metric tracks whether (and how effectively) a protocol can detect malicious behavior by validators or relayers, and automatically penalize them on-chain through slashing mechanisms.

The presence of robust dispute resolution systems signals two things:

- User protection: Bad actors face real economic consequences, deterring attacks and misbehavior.

- Ecosystem maturity: Protocols with automated slashing show they’ve moved beyond “trust us” models toward true trust minimization.

If you’re considering bridging high-value assets or integrating cross-chain messaging into mission-critical apps, demand clear coverage stats and evidence that disputes are resolved transparently, ideally with community oversight built in.

3 Essential Metrics for Trustworthy Cross-Chain Messaging

-

Bridge Contract Immutability Score: This metric measures how resistant a bridge’s smart contracts are to unauthorized changes. High immutability means the contract code cannot be altered after deployment, reducing the risk of backdoors or admin exploits. Established protocols like Wormhole and LayerZero often highlight their contract immutability to build user trust.

-

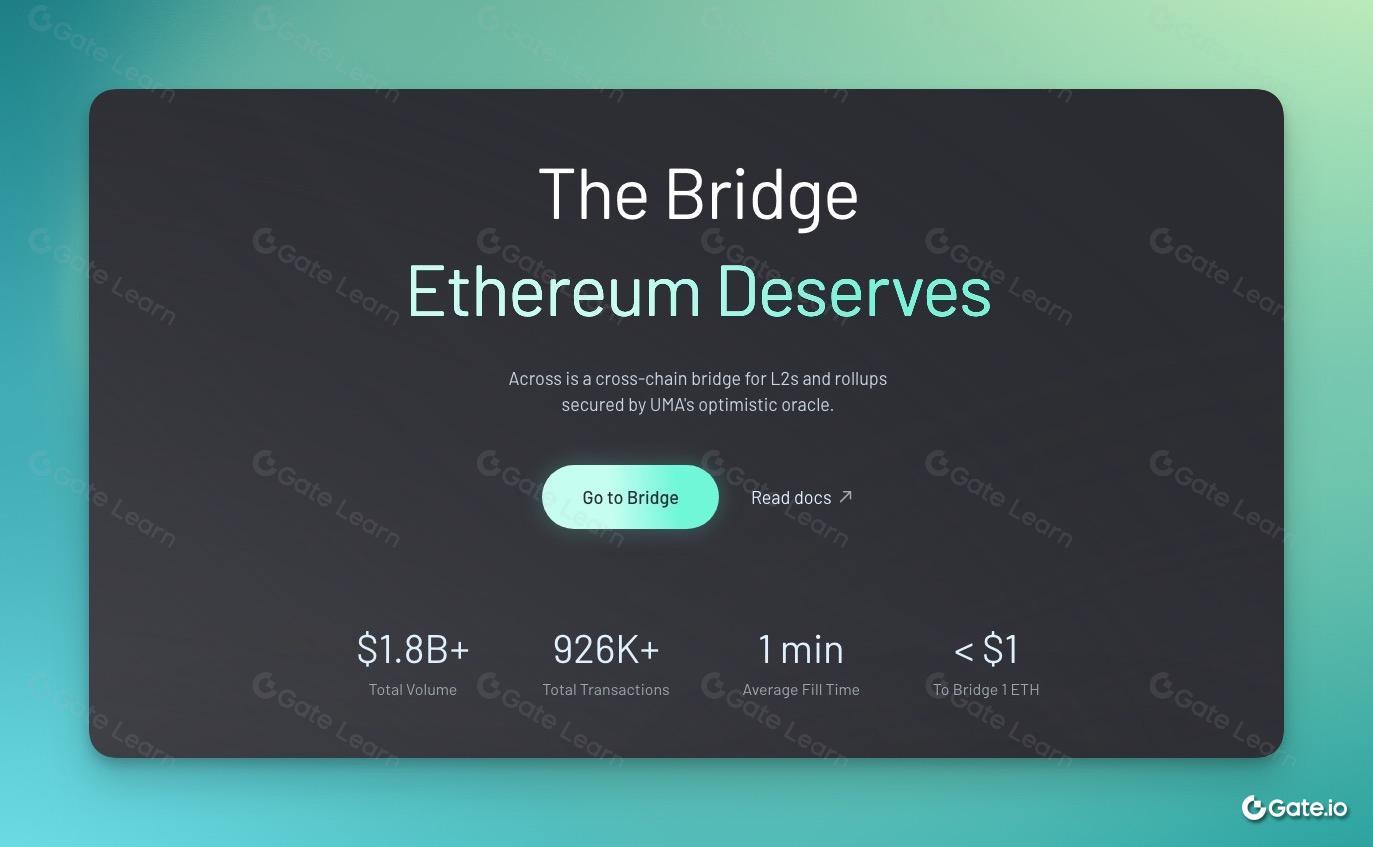

Cross-Chain Message Finality Time: This refers to the average time it takes for a message or transaction to be considered irreversible across different blockchains. Lower finality times mean faster confirmation and reduced risk of double-spending or message rollback. Platforms such as Axelar and Poly Network publish finality benchmarks to demonstrate operational reliability.

-

On-Chain Slashing/Dispute Resolution Coverage: This metric evaluates whether a platform has transparent, on-chain mechanisms to penalize malicious actors (slashing) and resolve disputes. Robust coverage ensures validators or relayers are held accountable, protecting users from fraud. Notable examples include Nomad and Circle CCTP, which implement slashing and dispute protocols to enhance security.

These three trust metrics aren’t just checkboxes for compliance, they’re live signals of a protocol’s real-world resilience. As the cross-chain ecosystem matures, DeFi users and institutional players are demanding more than just promises; they want verifiable proof that their funds and data are protected against both technical failures and human error.

Let’s look at how these metrics work together to create a holistic picture of trustworthiness:

- Bridge Contract Immutability Score ensures the rules of the game can’t be quietly changed after launch. High scores mean users can sleep easier, knowing that no central party can pull the rug or introduce silent vulnerabilities.

- Cross-Chain Message Finality Time directly impacts both risk and usability. Protocols with transparent, provable finality times let users make informed decisions about when it’s safe to act on transferred assets or data.

- On-Chain Slashing/Dispute Resolution Coverage closes the loop by holding all participants accountable. If something goes wrong, there’s a clear path for recourse, no backroom deals, no ambiguous outcomes.

This isn’t just theory. In recent months, we’ve seen projects with low immutability scores or weak dispute resolution suffer catastrophic exploits, while those with robust on-chain enforcement have weathered attacks with minimal user losses. The market is starting to reward bridges and messaging protocols that publish these metrics openly, and penalize those that treat them as afterthoughts.

Why These Metrics Matter for DeFi and Institutional Adoption

If you’re building or investing in DeFi protocols, NFT marketplaces, or enterprise blockchain solutions that rely on cross-chain messaging, these trust indicators are non-negotiable. Institutions especially demand quantifiable assurances before moving serious capital across chains. Transparent scores and coverage stats aren’t just nice-to-haves, they’re table stakes for onboarding the next wave of users.

The best part? These metrics are measurable and auditable by anyone. You don’t have to take a team’s word for it, check their published immutability audits, monitor real-time finality dashboards, and review slashing logs on-chain. This radical transparency is what sets blockchain interoperability apart from legacy finance.

3 Key Metrics for Trustworthy Cross-Chain Messaging

-

Bridge Contract Immutability Score: This metric evaluates how resistant a bridge contract is to unauthorized changes. High immutability means the contract’s code cannot be altered after deployment, reducing the risk of backdoors or governance attacks. Platforms like Wormhole and Polygon are increasingly emphasizing immutable smart contracts for enhanced security.

-

Cross-Chain Message Finality Time: This measures the speed and reliability with which messages or transactions sent between blockchains are considered irreversible. Shorter finality times mean users and dApps can trust that their cross-chain actions are settled quickly. Leading protocols like LayerZero and Axelar are known for optimizing message finality to just a few minutes or less.

-

On-Chain Slashing/Dispute Resolution Coverage: This metric assesses whether a platform has built-in, automated mechanisms to penalize malicious actors (slashing) and resolve disputes transparently. Robust coverage ensures that validators or relayers are held accountable, boosting trust for both DeFi and institutional users. Protocols like Nomad and Synapse incorporate on-chain slashing and dispute resolution to maintain operational integrity.

How to Stay Ahead: Tools and Community Insights

The landscape is evolving fast. Risk scanners like ours empower you to track these metrics in real time across leading bridges and messaging protocols, no technical background required. You’ll find up-to-date audit reports, community-driven reviews, and alerts about any shifts in immutability status or dispute coverage.

Your voice also matters! Join governance forums and DAOs where users help shape dispute policies or upgrade paths. The more decentralized oversight there is over these core metrics, the stronger our collective security becomes.

If you’re curious about how your favorite bridge stacks up, or you want to suggest new risk indicators, jump into our Discord or participate in community polls below!

Which trust metric matters most when evaluating a cross-chain bridge?

Cross-chain messaging platforms are evaluated using several key metrics, but when it comes to trust, which do you consider most important? Share your view to see how the community weighs these factors.