Cross-chain bridges are the connective tissue of decentralized finance, enabling asset and data transfers across otherwise isolated blockchains. Yet, these protocols have become notorious for their security gaps. According to recent data, over $2.8 billion has been lost to bridge exploits – a figure that dwarfs losses in nearly every other DeFi sector. Understanding the most critical blockchain bridge vulnerabilities is essential for anyone building or relying on cross-chain messaging infrastructure.

1. Compromised or Poorly Managed Validator Keys

The security of most cross-chain bridges hinges on validator nodes that sign and relay messages between chains. If an attacker obtains access to a quorum of validator private keys, they can approve arbitrary transactions or drain assets locked in the bridge contract. The infamous Ronin Bridge hack stemmed from compromised validator keys, resulting in a $600 million loss. Weak operational security, lack of hardware key storage, and inadequate key rotation policies amplify this risk.

2. Unaudited or Outdated Bridge Smart Contracts

Bridge smart contracts are complex and often handle hundreds of millions in value. Deploying unaudited or outdated contracts exposes protocols to logic errors, unchecked edge cases, and overlooked vulnerabilities. Even minor bugs can be catastrophic; recall that the Wormhole exploit was traced back to a missed signature verification check in its Solana-side contract logic (source). Continuous auditing and formal verification are non-negotiable for any serious bridge deployment.

3. Unsafe External Calls Enabling Re-Entrancy Attacks

Bridges frequently interact with external contracts when locking assets or minting wrapped tokens on destination chains. If these external calls aren’t tightly controlled, attackers can exploit re-entrancy bugs – repeatedly invoking a vulnerable function before state changes persist – to siphon funds or bypass withdrawal restrictions. The Poly Network hack remains one of the most costly examples of this pattern in practice.

Key Cross-Chain Messaging Risks

Top 7 Cross-Chain Bridge Vulnerabilities

-

Compromised or Poorly Managed Validator Keys: Attackers target validator nodes or multi-signature wallets to steal private keys, as seen in the Ronin Bridge and Harmony Horizon exploits, resulting in losses exceeding $600 million and $100 million respectively. Rigorous key management and decentralized validator sets are essential to mitigate this risk.

-

Unaudited or Outdated Bridge Smart Contracts: Vulnerabilities in unreviewed or obsolete smart contracts can be exploited, as demonstrated by the Wormhole Bridge hack, where a signature verification bug enabled attackers to mint 120,000 wETH (~$325 million). Regular, thorough audits are critical for security.

-

Unsafe External Calls Enabling Re-Entrancy Attacks: Bridges that allow unprotected external contract calls are vulnerable to re-entrancy exploits, where attackers recursively trigger withdrawals. This flaw has caused major losses in DeFi protocols and remains a significant cross-chain risk.

-

Insufficient Message Authentication and Replay Protection: Without robust nonce or signature checks, attackers can replay valid cross-chain messages, duplicating asset transfers or draining liquidity pools. Secure message verification is vital for bridge integrity.

-

Centralized Relayer or Oracle Manipulation: Bridges relying on a few relayers or oracles are exposed to manipulation or collusion, leading to unauthorized asset releases or fake cross-chain events. Decentralized, transparent relayer/oracle systems reduce this threat.

-

Inadequate Cross-Chain Event Verification: Weak validation of cross-chain events or proofs allows attackers to forge or tamper with transaction data, undermining trust in the bridge. Strong cryptographic verification and consensus mechanisms are required.

-

Lack of Robust Upgrade and Governance Controls: Poorly managed upgrade processes or centralized governance can introduce new vulnerabilities or backdoors, putting user funds at risk. Secure, transparent governance and upgrade mechanisms are essential for long-term bridge security.

The next generation of cross-chain messaging must address these fundamental attack surfaces by design rather than as an afterthought. In the following sections, we’ll dissect additional flaws threatening interoperability and outline actionable mitigation strategies for developers and protocol architects alike.

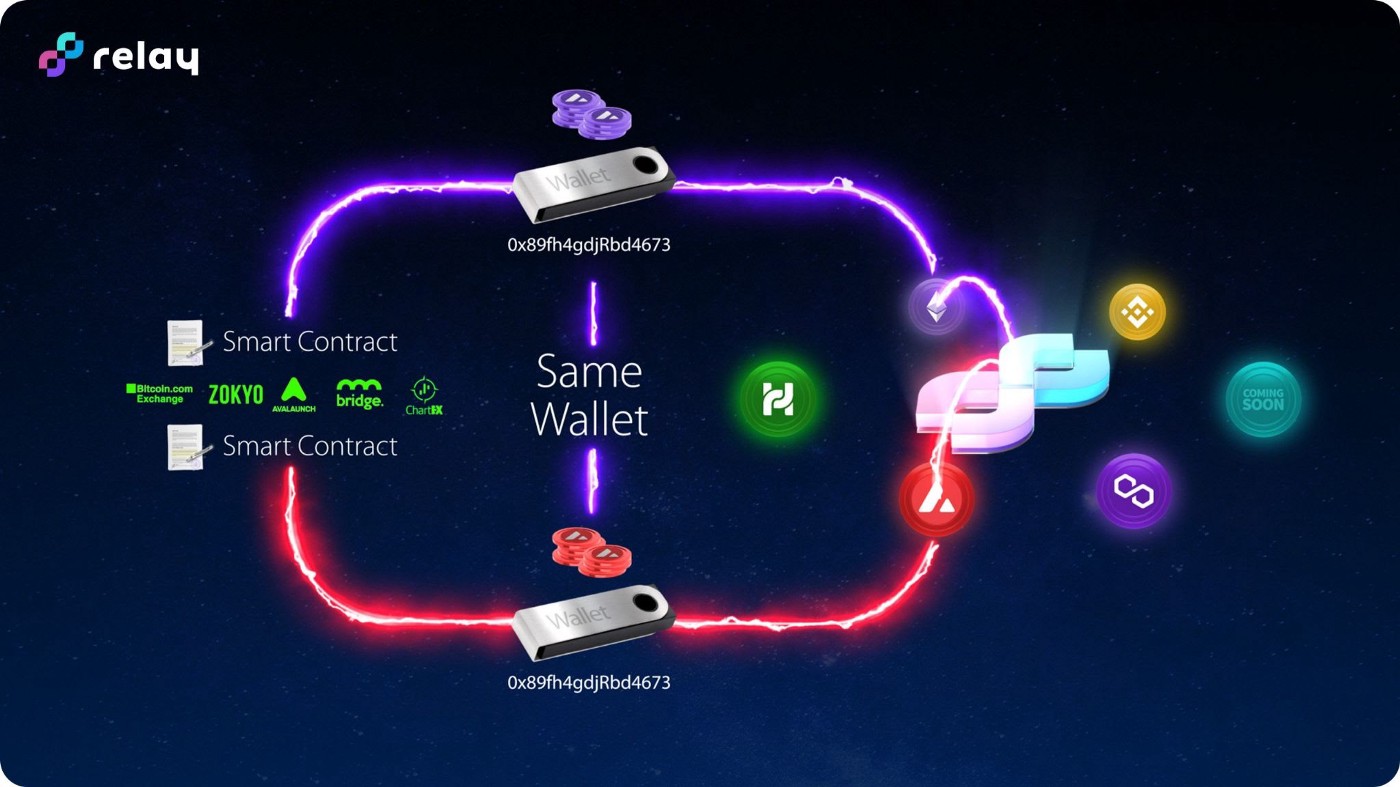

4. Insufficient Message Authentication and Replay Protection

Robust cross-chain messaging demands airtight authentication of every message, yet many bridges lack adequate replay protection or unique transaction identifiers. Without these safeguards, attackers can duplicate valid messages, triggering repeated asset releases or unauthorized state changes. The absence of strong nonce management and signature validation creates an environment where replay attacks can go undetected until significant losses occur. Developers must implement strict message uniqueness checks and cryptographic proofs to ensure that each cross-chain event is processed only once.

5. Centralized Relayer or Oracle Manipulation

Many bridges depend on a small set of relayers or oracles to propagate cross-chain events and validate external data. This centralization introduces a critical point of failure: if a malicious actor compromises the relayer infrastructure or manipulates oracle inputs, they can inject fraudulent transactions, disrupt consensus, or misprice assets in transit. The Harmony Horizon bridge exploit underscored how minimal validator diversity and centralized relayer control can lead directly to catastrophic breaches (source). Decentralizing relayer sets and employing multiple independent oracle sources are essential steps toward mitigating this systemic risk.

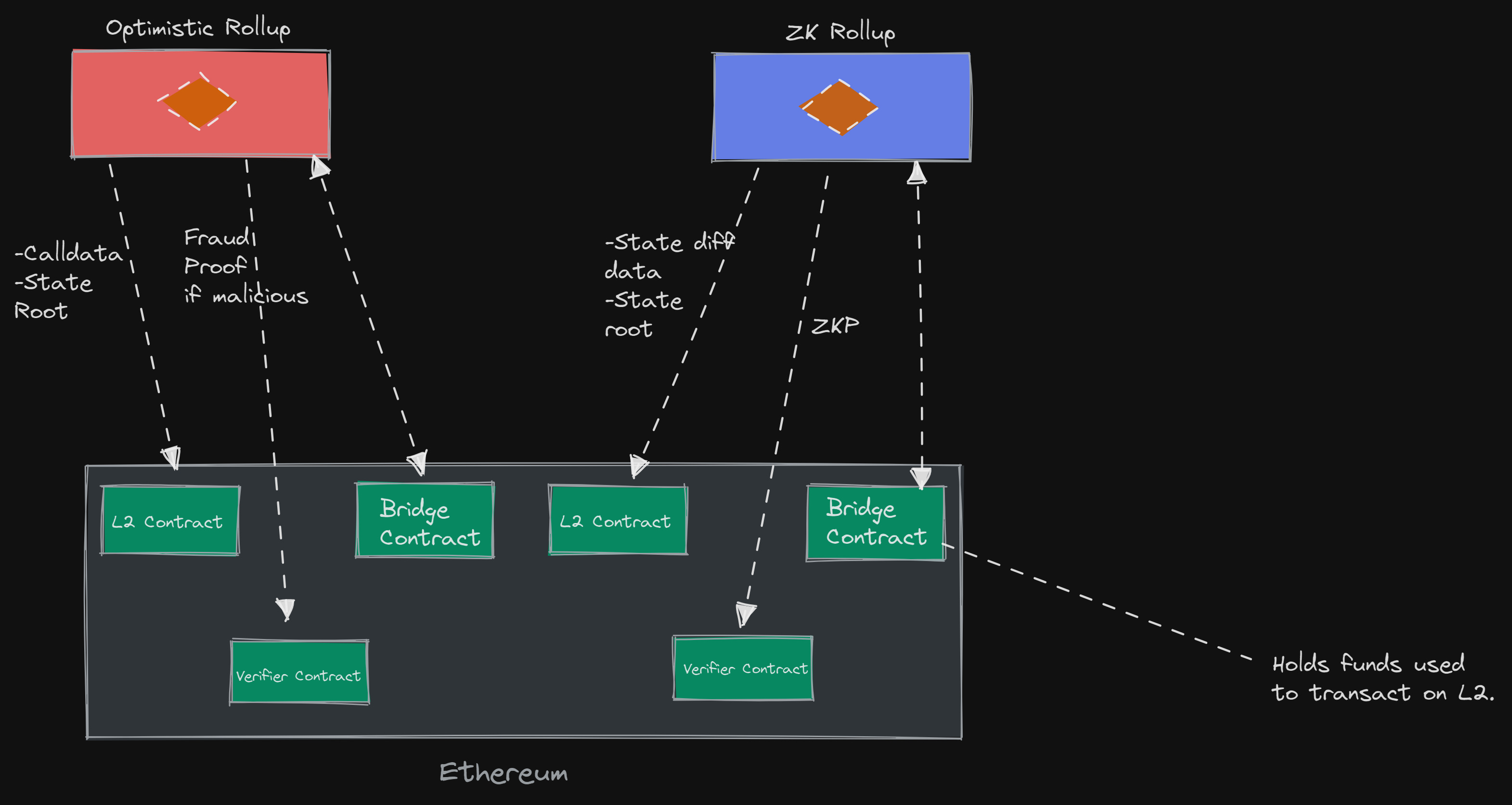

6. Inadequate Cross-Chain Event Verification

Bridges must accurately verify that events on one chain have genuinely occurred before acting on another chain. Weaknesses in event verification logic, such as improper Merkle proof validation, unchecked block headers, or reliance on unauthenticated data, allow adversaries to fabricate events and trick the bridge into minting unbacked tokens or releasing collateral without legitimate cause. Effective solutions include rigorous light client implementations, robust cryptographic proofs, and continuous monitoring for anomalous event patterns.

7. Lack of Robust Upgrade and Governance Controls

Bridge protocols inevitably require upgrades to patch vulnerabilities or add features, but insecure upgrade mechanisms can be weaponized by attackers, or even rogue insiders, to introduce malicious code or seize administrative privileges. Many incidents have involved poorly governed upgrade paths with insufficient multi-party approval thresholds or opaque governance structures. To counteract this threat, protocols should enforce transparent upgrade processes with time delays, multisig authorization, and community oversight wherever feasible.

Proactive Measures: The most resilient bridges are those that treat security as an ongoing process, not a one-time audit checkbox. Continuous monitoring for suspicious validator activity, automated detection of replay attempts, regular contract upgrades with full transparency, and open bounty programs all contribute to a more robust cross-chain ecosystem.

The rapid pace of DeFi innovation means new attack vectors will continue to emerge. However, by addressing these seven core vulnerabilities, validator key management, smart contract auditing, safe handling of external calls, strong message authentication, decentralized relayers/oracles, rigorous event verification, and secure governance controls, protocol teams can dramatically reduce their risk exposure.

For developers building the next wave of interoperability tools, and for users entrusting their assets to these protocols, the stakes could not be higher. As history has shown across Ronin Bridge ($600 million), Wormhole ($325 million), Harmony Horizon ($100 million), and Poly Network (over $600 million) exploits: overlooking any single layer in the security stack is an invitation for disaster.