Cross-chain bridges are the connective tissue of blockchain interoperability, moving assets and data between networks like Ethereum, Solana, and beyond. But with $2 billion stolen across 13 cross-chain bridge hacks in the past year alone, it’s clear: security is the battleground. The good news? Cryptography is fighting back. Two of the most promising defenders are Multi-Party Computation (MPC) and Threshold Signature Schemes (TSS). Let’s break down how these technologies are reshaping cross-chain bridge security for a more resilient DeFi future.

Why Are Cross-Chain Bridges So Vulnerable?

Think of a bridge as a vault holding assets on multiple blockchains, if the vault’s key is compromised, everything inside is at risk. Traditional multi-signature (multisig) setups require several parties to sign off on transactions, but each signer holds a full private key share. Attackers only need to compromise enough signers to steal funds or disrupt operations.

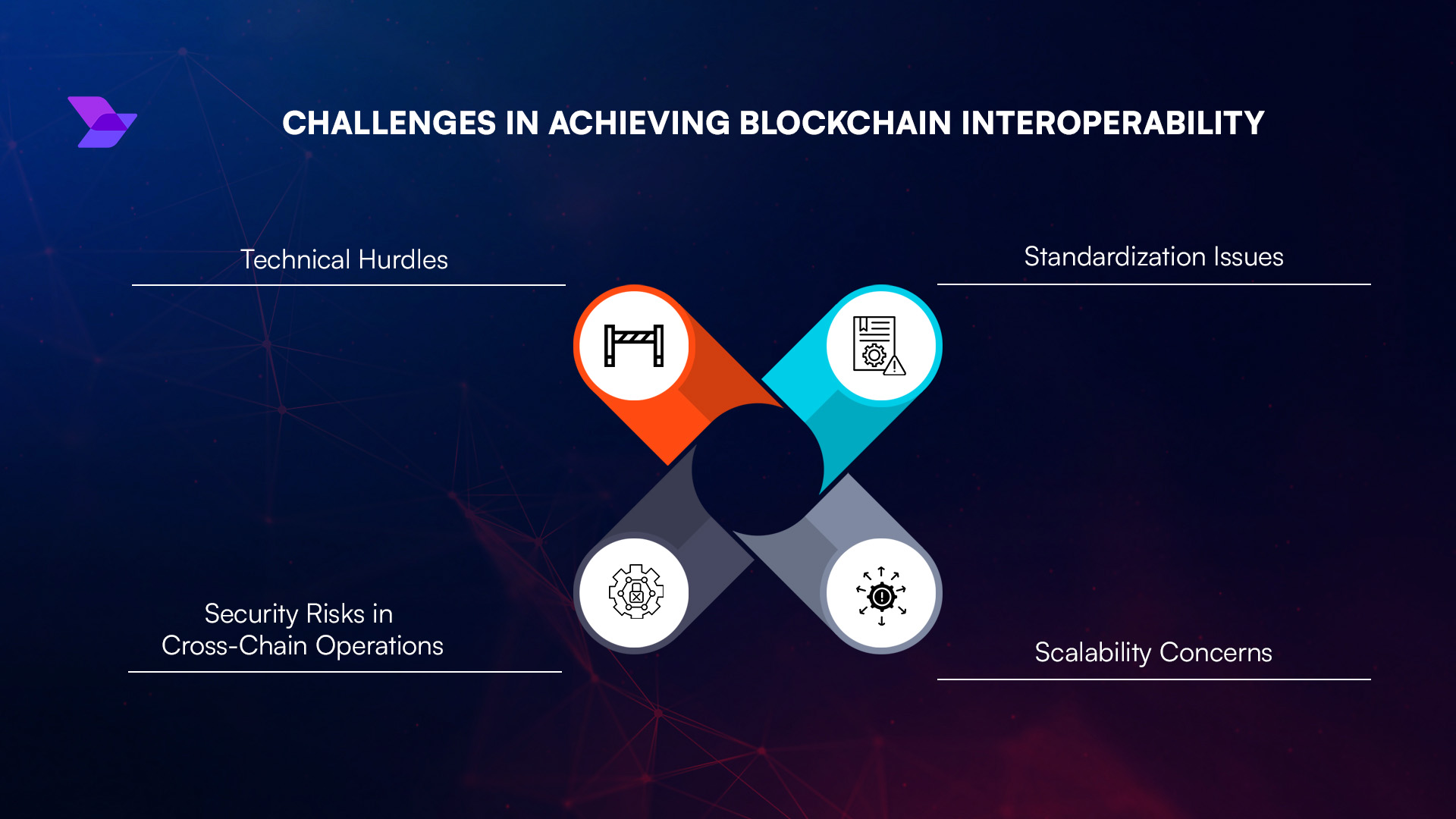

The problem gets even bigger when you factor in:

- Centralized relayers: If one party goes rogue or gets hacked, they can drain user funds.

- Smart contract bugs: Code vulnerabilities can be exploited before anyone notices.

- Lack of transparency: Users often don’t know who controls the keys or how signatures are generated.

This is where MPC and TSS step in with a fresh approach to trustless cross-chain transfers.

MPC and amp; TSS: The Cryptographic Guardians

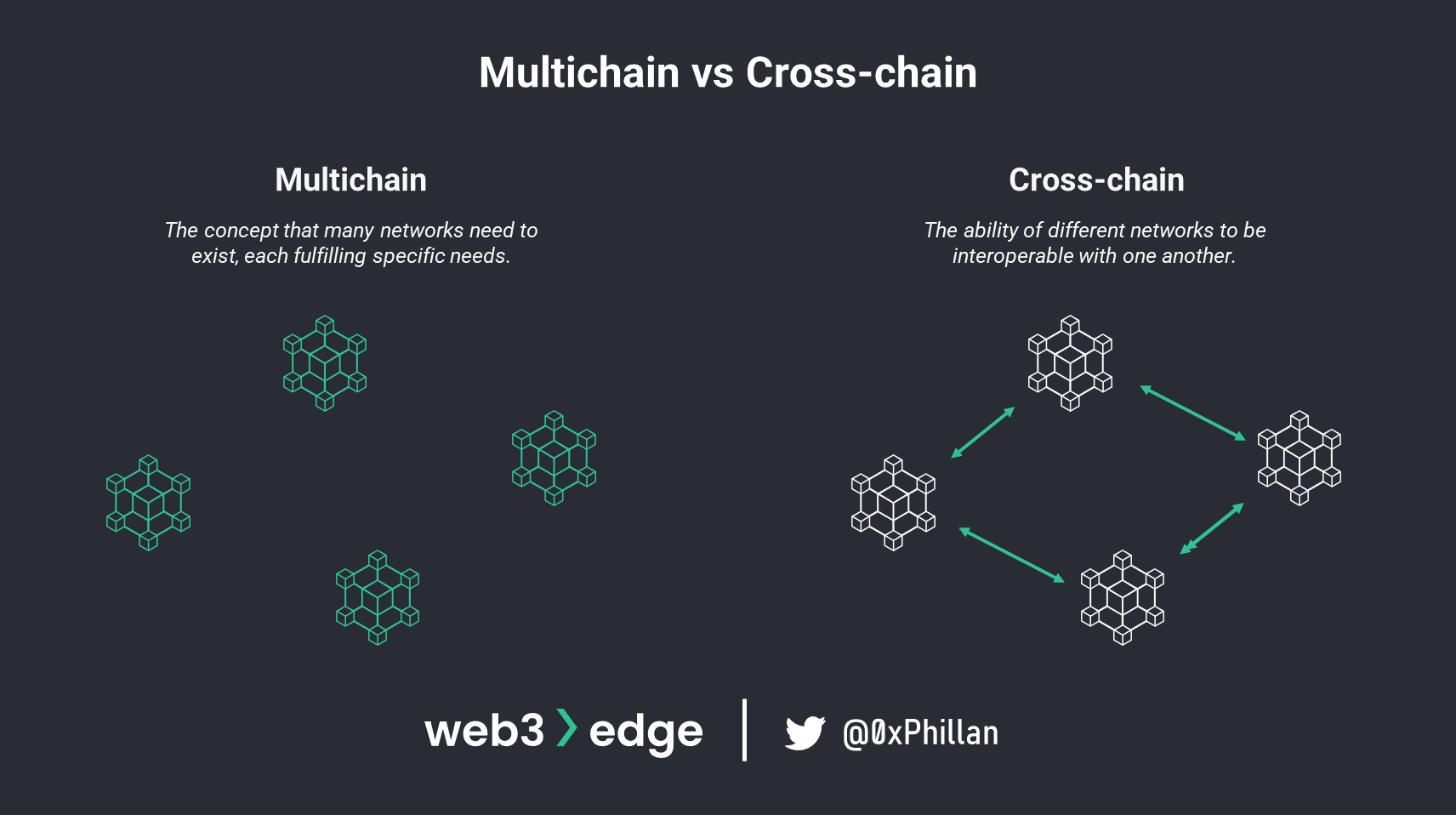

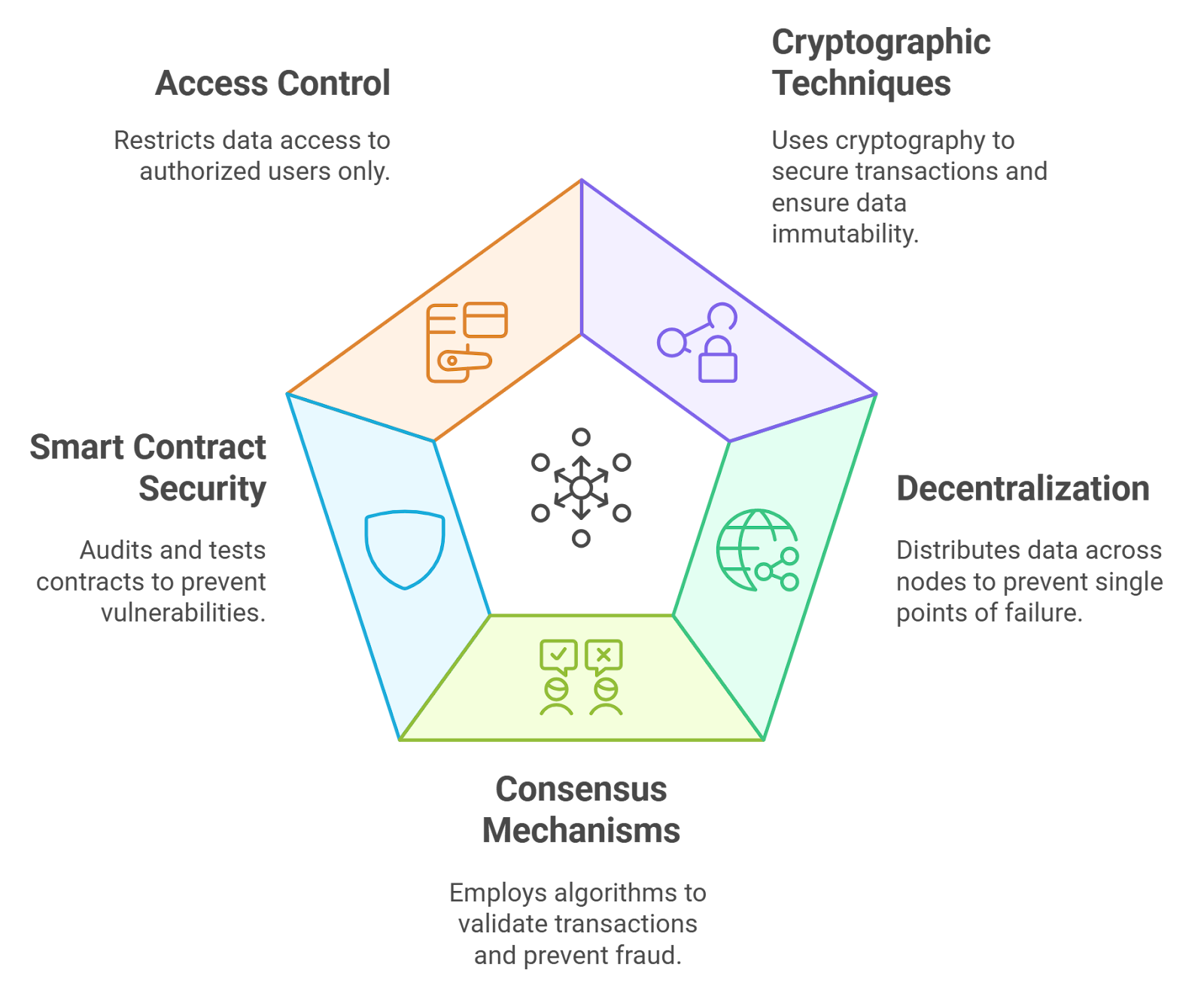

Multi-Party Computation (MPC) lets multiple parties compute functions together without revealing their private data to each other. In practice, this means no single entity ever has access to the full private key, it’s split up and never reassembled. Even if one party is compromised, an attacker can’t steal the key outright.

Threshold Signature Schemes (TSS), a specialized form of MPC, divide control over a private key among several parties. Only when a minimum threshold (say, 3 out of 5) agree can they produce a valid signature for a transaction. This makes it much harder for attackers, they’d need to compromise multiple independent operators at once.

The result? No single point of failure. And that’s huge for DeFi users who want peace of mind when bridging assets across chains like Ethereum and Binance Smart Chain.

MPC vs Multisig: What’s Actually Different?

At first glance, MPC bridges and multisig bridges might seem similar, both distribute trust among several parties. But dig deeper:

- MPC/TSS signatures look just like regular single signatures on-chain, so attackers can’t tell how many parties were involved or who signed what.

- No public list of signers is exposed, which removes social engineering targets from public view.

- MPC allows seamless key rotation/offboarding without costly on-chain changes.

- TSS aggregation keeps transaction sizes small and fees low, compared to bulkier multisig transactions that bloat costs and leak information about participants.

This privacy-preserving design makes MPC/TSS bridges less attractive targets for hackers looking for easy exploits or doxxing opportunities. For developers and protocol designers, it means less operational headache and more agility as teams grow or change hands.

Of course, no technology is bulletproof. Recent research, like the TSSHOCK attack uncovered by Verichains, reminds us that even threshold cryptography can harbor critical flaws if not implemented and audited rigorously. In TSSHOCK’s case, a single malicious party could extract the full private key, an exploit that completely undermines the trustless premise of TSS. This highlights a vital truth: security is as much about operational discipline and code review as it is about cryptographic strength.

Best Practices for Real-World Bridge Security

If you’re building or using cross-chain bridges leveraging MPC or TSS, here’s how to stay ahead of evolving threats:

Best Practices for MPC/TSS Bridge Security

-

Stay Informed About Emerging Vulnerabilities: Regularly monitor trusted sources like Chainlink and Binance Security Blog for updates on vulnerabilities such as TSSHOCK and other cross-chain bridge exploits.

-

Use Bridges with Proven MPC/TSS Implementations: Opt for bridges like Multichain and Wanchain that publicly document their use of secure MPC and TSS protocols, ensuring distributed key management and robust cryptography.

-

Implement Regular Key Share Rotation and Auditing: For developers, establish automated processes for periodic key share rotation and independent security audits to minimize the risk of key extraction attacks and insider threats.

-

Minimize On-Chain Exposure of Key Management: Leverage off-chain key management features of TSS to avoid exposing sensitive operations to the blockchain, reducing the attack surface for potential exploits.

-

Monitor Node Health and Network Activity: Continuously monitor the health and activity of all MPC/TSS nodes, as coordinated attacks often target node downtime or network partitioning to compromise bridge security.

-

Choose Bridges with Transparent Security Practices: Select platforms that provide detailed documentation, open-source code, and third-party audit reports, allowing users and developers to verify security claims.

-

Participate in Responsible Disclosure Programs: Engage with bridges that offer bug bounty or responsible disclosure programs, encouraging the community to report vulnerabilities before they can be exploited.

Continuous auditing is non-negotiable. Protocols must undergo regular external reviews to catch subtle bugs before attackers do. Diversity of node operators helps prevent collusion and reduces the risk posed by any single compromised entity. Transparent incident reporting builds community trust and accelerates threat response across the ecosystem.

The most robust bridges also adopt defense-in-depth strategies, combining smart contract audits, formal verification, bug bounty programs, and real-time risk monitoring tools. This multi-layered approach is essential because as attackers get smarter, so must our defenses.

What’s Next for Cross-Chain Security?

The future of blockchain interoperability depends on more than just clever math. As DeFi matures and bridges handle ever-larger flows of value, we’ll see:

- Greater adoption of MPC/TSS in both established and emerging bridges, especially as off-the-shelf libraries become more battle-tested.

- Hybrid models that blend on-chain governance with off-chain threshold cryptography for maximum flexibility and resilience.

- User education campaigns, helping everyday DeFi participants understand what’s happening under the hood, and why it matters for their funds’ safety.

- Rapid response frameworks to coordinate between protocols when new vulnerabilities (like TSSHOCK) are discovered.

If you’re a developer or security researcher in this space, now is the time to double down on transparency and collaboration. Share findings openly. Participate in cross-bridge audits. Push for higher standards across the board, because every improvement lifts the entire ecosystem.

Bottom Line: Trustless Bridges Are Built on Relentless Vigilance

MPC and TSS aren’t silver bullets, but they are powerful shields when used wisely. The next generation of cross-chain bridges will be defined by their ability to distribute trust without sacrificing usability or efficiency. If we get this right, we unlock a world where assets flow freely across blockchains, without making users choose between convenience and safety.

The journey doesn’t end here. Stay curious, scrutinize every protocol you use or build, and demand transparency from bridge operators. As always: ride the trend, respect the risk.