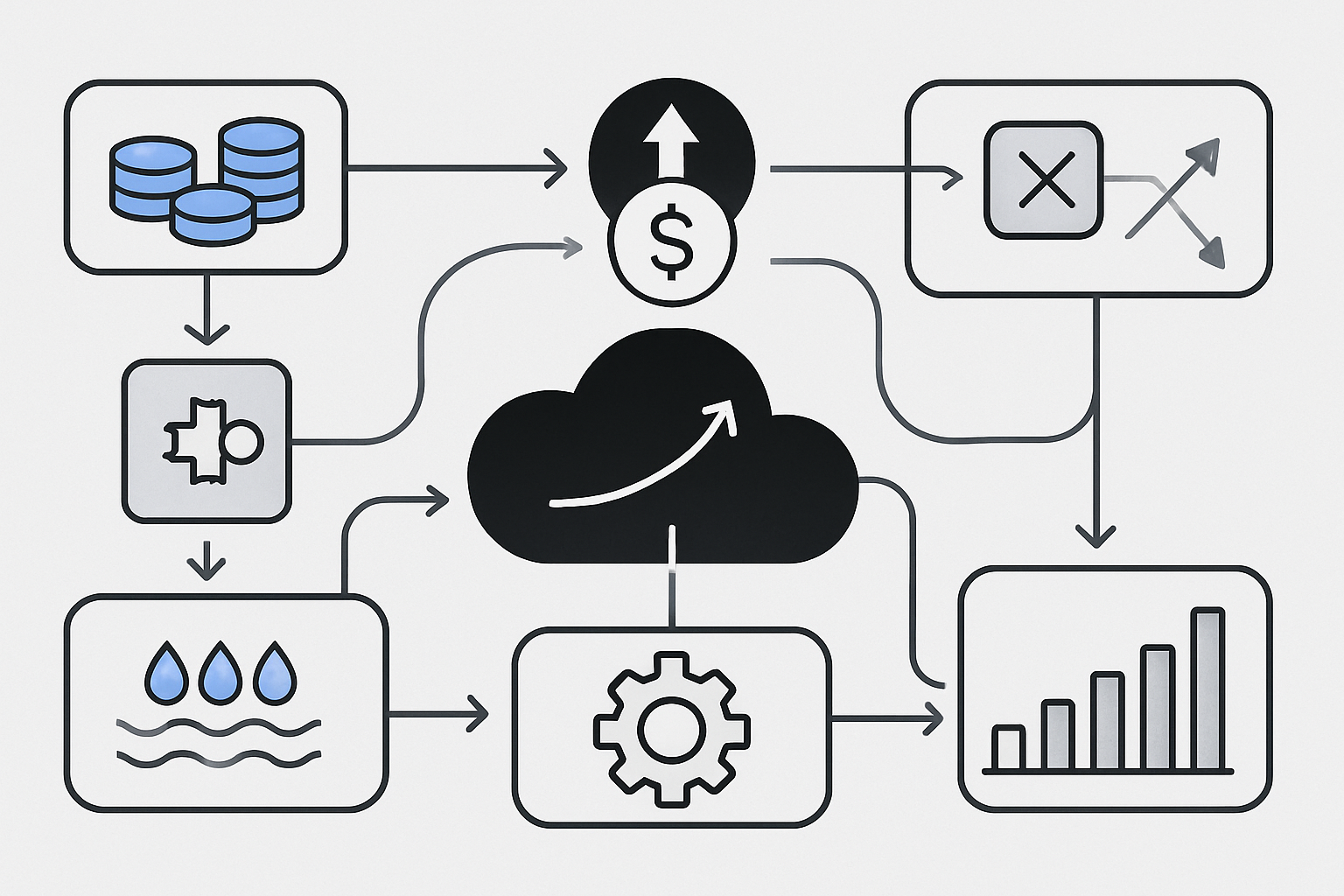

In the relentless pursuit of blockchain interoperability, cross-chain bridges have become the arteries of DeFi. Yet, as these digital highways expand, so too do the risks lurking beneath their surface. Among the most critical, and paradoxical, threats are those posed by centralized bridge custody models. While these structures bring convenience and liquidity, they also introduce systemic weaknesses that threaten to undermine DeFi’s foundational promise of trustless finance.

Centralized Bridge Risk: The Single Point of Failure

The appeal of centralized bridges is clear: fast settlement, familiar user experience, and seemingly seamless asset transfer between chains. However, this convenience comes at a steep price. Centralized custodians, such as BitGo in the Wrapped Bitcoin (WBTC) model, hold the underlying assets that back wrapped tokens circulating on Ethereum and other networks. This setup creates a single point of failure: if the custodian is compromised or becomes insolvent, all users holding wrapped assets are exposed to catastrophic loss.

This is not theoretical. The DeFi ecosystem has already witnessed major bridge hacks and custody failures resulting in losses that ripple across protocols. According to recent research from Chainlink and Quantstamp, cross-chain bridges have been targeted in some of the largest exploits in DeFi history, with attackers exploiting vulnerabilities unique to both smart contracts and their centralized operational models.

Counterparty Exposure Amplifies Contagion Risk

The systemic risk introduced by centralized custody models extends beyond technical vulnerabilities. There is an ever-present counterparty risk, if the custodian fails due to fraud, regulatory action, or operational error, users may lose access to their assets or find them frozen indefinitely. This risk is magnified by the interconnectedness of DeFi protocols: WBTC alone underpins billions in collateral for lending markets, stablecoins, and yield farms.

Consider a scenario where a major protocol using WBTC as collateral suffers a breach or insolvency event. A mass redemption rush could ensue as investors scramble to convert WBTC back into BTC via the central custodian. If that custodian falters under pressure, be it from technical issues or legal intervention, the result could be a broken peg between WBTC and BTC, cascading liquidations across multiple platforms, and systemic panic throughout DeFi markets.

Regulatory Vulnerabilities: The Sword Overhead

Centralized custody models are also uniquely vulnerable to regulatory intervention, a fact often overlooked in discussions about “trust minimization. ” Custodians operating across jurisdictions must comply with an array of KYC/AML requirements, securities laws, and evolving stablecoin regulations. Any abrupt regulatory shift can force policy changes or even outright shutdowns without warning.

This regulatory sword hanging overhead means that even if technical security is robust, operational continuity can never be fully guaranteed for users relying on centralized bridges. In effect, this undermines one of DeFi’s core value propositions: censorship resistance and permissionless access.

The risks of centralized bridge custody are not limited to hypothetical scenarios or regulatory crackdowns. History has repeatedly shown that even the most sophisticated custodial models are susceptible to both internal and external threats. Whether it’s a targeted hack, insider collusion, or simple operational mismanagement, the fallout from a single point of failure can quickly spiral into a systemic crisis for the broader DeFi ecosystem.

Major Bridge Hacks That Shook DeFi

-

Ronin Bridge Hack (March 2022): The Ronin Network, powering Axie Infinity, suffered a $625 million exploit when attackers compromised validator keys, exposing the risks of centralized bridge control. This event triggered industry-wide scrutiny of bridge security.

-

Wormhole Bridge Exploit (February 2022): The Wormhole cross-chain bridge lost $320 million in ETH after a smart contract vulnerability was exploited. The incident highlighted the dangers of smart contract flaws in cross-chain bridges and led to a swift bailout by Jump Crypto.

-

Poly Network Hack (August 2021): Poly Network was drained of over $600 million due to a flaw in its cross-chain contract logic. Although most funds were eventually returned, the hack revealed the systemic risks of complex bridge protocols.

-

Binance Bridge (BSC Token Hub) Hack (October 2022): Attackers exploited a vulnerability in the BSC Token Hub bridge, minting $570 million worth of BNB. The incident forced a temporary network halt and underscored the threat of centralized bridge points of failure.

-

Harmony Horizon Bridge Hack (June 2022): The Horizon Bridge on Harmony lost $100 million due to compromised multisig wallets, demonstrating how limited validator decentralization can expose bridges to catastrophic losses.

Moreover, the “lock and mint” model, where assets are locked with a custodian and synthetic tokens are minted on another chain, creates additional attack vectors. Double issuance, inflationary exploits, and relayer vulnerabilities have all been exploited in recent bridge failures. Each incident chips away at user confidence and feeds into a cycle of risk aversion that stifles innovation across chains.

Emerging Solutions: Decentralizing the Cross-Chain Future

Recognizing these inherent weaknesses, the DeFi community is doubling down on decentralized custody innovations. Protocols like Hemi are pioneering frameworks that distribute control over asset custody among multiple independent validators, reducing reliance on any single entity. By leveraging threshold signatures and cryptographic guarantees, these models aim to make cross-chain transfers as trust-minimized as possible.

Simultaneously, governance mechanisms such as veTokenomics are gaining traction as tools for mitigating concentrated power among custodians and centralized exchanges. By incentivizing longer-term token locking and distributing voting power more widely, protocols can resist governance capture while aligning incentives toward security and sustainability.

Best Practices for Navigating Bridge Security

For developers, investors, and users alike, navigating the risks associated with centralized bridges requires a disciplined approach:

- Perform rigorous due diligence on any bridge’s custody model before interacting with it.

- Diversify exposure across multiple bridges or opt for decentralized alternatives when possible.

- Monitor regulatory developments, especially if using bridges operated by entities in highly regulated jurisdictions.

- Stay informed about technical upgrades or audits performed on bridge contracts.

The path forward is clear: while centralized bridges have played a pivotal role in bootstrapping cross-chain liquidity, their systemic risks cannot be ignored as DeFi matures. The future of secure interoperability lies in decentralized architectures that eliminate single points of failure, restoring user sovereignty without sacrificing composability or capital efficiency.