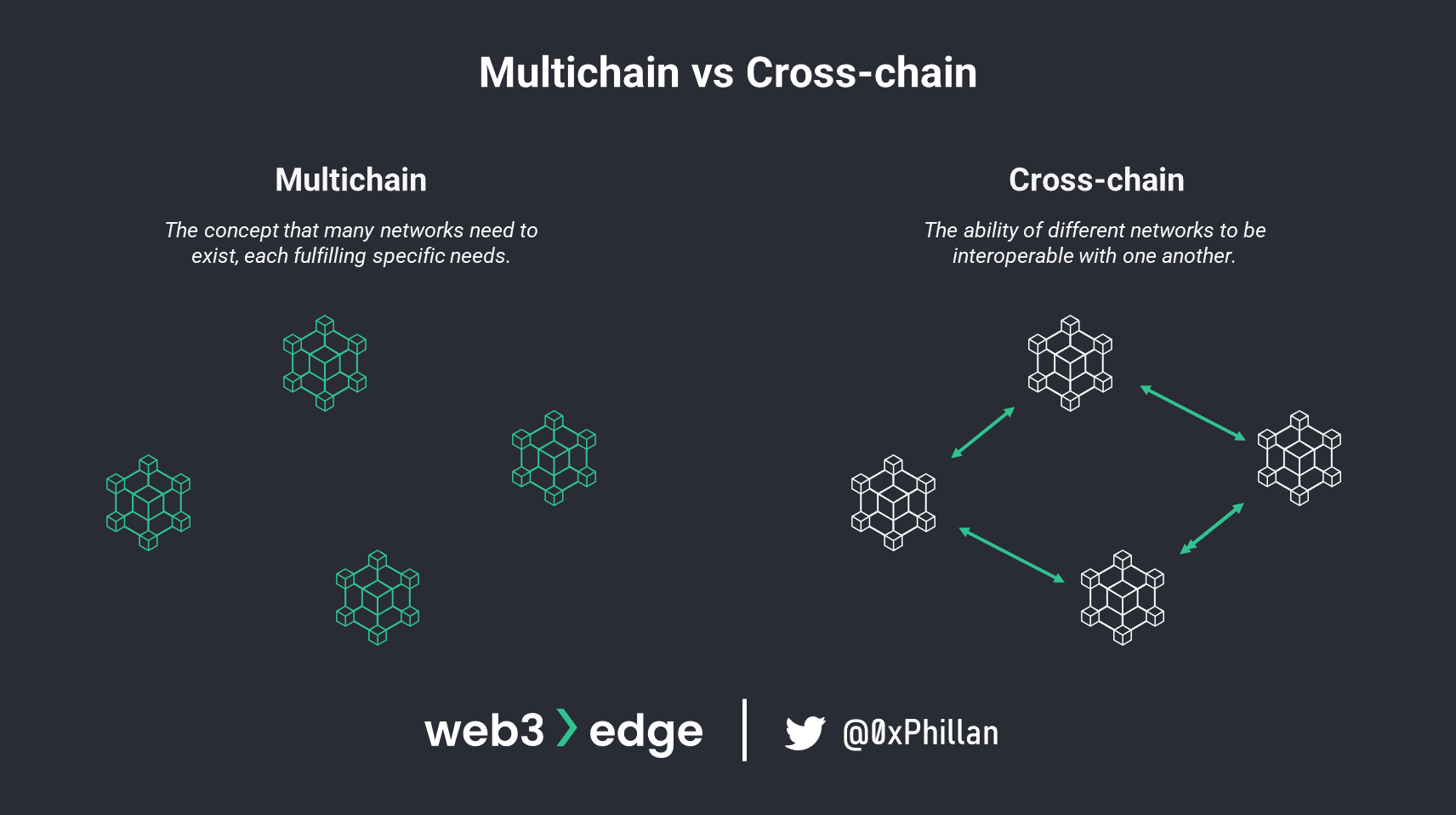

Cross-chain bridges are the lifeblood of blockchain interoperability, letting assets and data flow freely between chains. But under the hood, the trust models that make these bridges work can also create hidden risks that too often go unnoticed by developers. With nearly $4.3 billion lost to cross-chain bridge hacks since 2021, understanding these trust assumptions is no longer optional, it’s essential for anyone building or using these protocols.

How Trust Models Shape Cross-Chain Security Risks

At the core of every cross-chain bridge is a trust model: a set of assumptions about who verifies transactions, who controls the keys, and how consensus is reached across chains. These models range from fully centralized (one company or multisig controls everything) to more decentralized validator sets. Each approach comes with unique vulnerabilities.

Recent research and post-mortems, including this deep dive into bridge security risks, highlight a sobering trend: the majority of catastrophic hacks exploit flaws in the underlying trust architecture, not just smart contract bugs. Centralized bridges are especially vulnerable, if attackers compromise the small group of validators or multisig signers, they can drain all funds in a single blow. The Ronin Bridge hack is the poster child for this risk, where control of just five out of nine keys led to a loss of over $625 million.

Validator Design: The Double-Edged Sword

Validator sets are meant to distribute trust. In theory, more validators mean more security. In practice, however, many bridges fall short, either due to economic incentives, technical complexity, or sheer convenience. When a protocol relies on a handful of validators or poorly secured multisigs, it creates a single point of failure. Attackers only need to compromise a majority to approve fraudulent transactions and unlock funds.

This is not just theoretical. Chainalysis reports that bridge hacks accounted for more than half of all DeFi losses in recent years, with validator compromise being a recurring theme. Even so-called “decentralized” bridges often concentrate power in ways that are invisible to end users but obvious to sophisticated attackers.

Key Validator Model Flaws Exposing Cross-Chain Bridges

-

Centralized Validator Sets: Many bridges rely on a small group of validators or multisignature wallets, making them vulnerable if a majority are compromised. The Ronin Bridge hack in March 2022, where attackers gained control of five out of nine validator keys, resulted in over $625 million in losses.

-

Inadequate Validator Incentives: Weak or misaligned incentives can lead to validators acting maliciously or neglecting their duties. Without robust economic rewards and penalties, validators may collude or fail to secure the bridge properly.

-

Insufficient Validator Decentralization: When validator nodes are geographically or organizationally clustered, a single point of failure emerges. This centralization increases the risk of coordinated attacks or regulatory intervention.

-

Poor Key Management Practices: Bridges that lack secure key storage and rotation procedures expose validator keys to theft. Compromised keys can allow attackers to approve fraudulent transactions and drain funds.

-

Lack of Transparent Governance: Opaque validator selection and governance processes make it difficult for users to assess bridge security. Without transparency, malicious actors may infiltrate validator sets unnoticed.

-

Overreliance on Off-Chain Oracles: Some validator models depend heavily on off-chain oracles for consensus. If these oracles are compromised or manipulated, attackers can submit false data and trigger unauthorized asset transfers.

The Hidden Dangers of Smart Contract Complexity

Beyond validator risks, smart contract vulnerabilities add another layer of danger. Bridges must coordinate complex logic across multiple blockchains, a recipe for subtle bugs and logic flaws. The infamous Wormhole hack in 2022 is a classic example: a contract bug allowed an attacker to mint 120,000 wETH on Solana without any real Ether backing it on Ethereum.

These issues aren’t isolated incidents. Studies like those from CertiK and ACM Digital Library show that bridge contracts are among the most complex (and least tested) in all of DeFi. With so much value at stake and so many moving parts, even minor oversights can have catastrophic consequences.

Why Developers Need Deep Audit Insights

If you’re building or integrating with cross-chain messaging protocols, it’s time to take audit insights seriously. Regular audits and formal verification are crucial, but they’re just the start. Developers should dig into past hacks, understand how trust models failed, and use real-time risk scanning tools to catch emerging threats before they become headlines. For a practical framework on evaluating bridge security, check out this step-by-step guide.

But audits and frameworks alone aren’t enough. The pace of bridge innovation means new risks are constantly emerging, often in ways that traditional audits can’t anticipate. Attackers are watching closely for overlooked assumptions in validator design, emergency admin keys, or ambiguous consensus rules. The challenge for developers is to think adversarially: if you were an attacker, where would you strike? Which part of the trust model is most brittle?

Mitigation Strategies That Actually Work

Let’s get actionable. If you want to build bridges that stand the test of time and adversarial scrutiny, focus on these high-impact strategies:

Practical Steps to Reduce Cross-Chain Bridge Risks

-

Conduct Regular Smart Contract Audits: Partner with reputable firms such as CertiK or Trail of Bits to perform in-depth code reviews and formal verification, helping to identify vulnerabilities before exploitation.

-

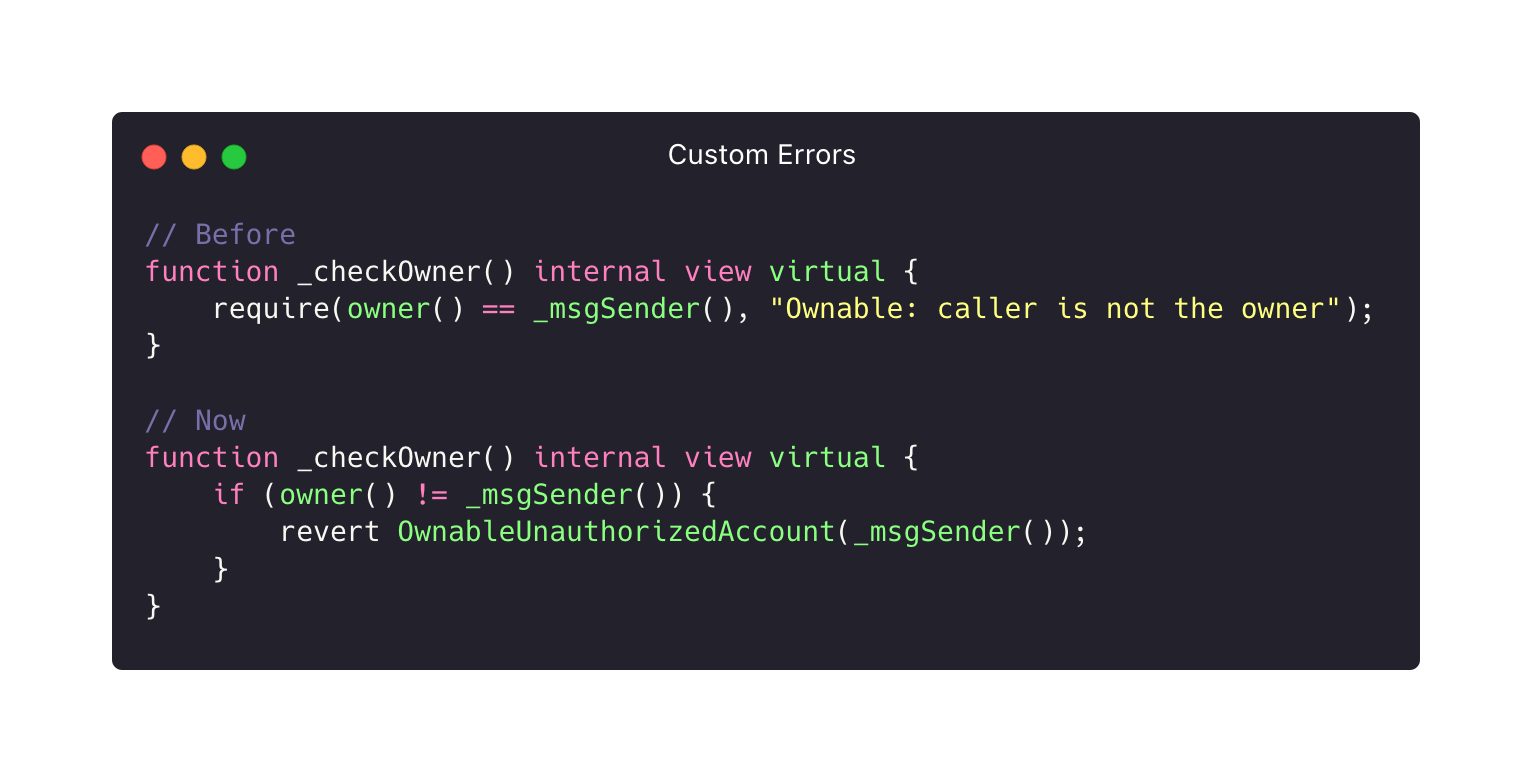

Implement Robust Access Controls: Use industry-standard solutions like OpenZeppelin Contracts to manage permissions, ensuring only authorized parties can execute critical functions within the bridge.

-

Deploy Real-Time Monitoring and Detection Tools: Integrate monitoring platforms such as BridgeGuard and XChainWatcher to detect suspicious activity and respond to threats as they emerge.

-

Maintain Transparent Incident Response Plans: Develop and publicly share clear protocols for responding to bridge exploits, similar to the approach taken by Wormhole after the 2022 hack. This builds user trust and helps coordinate rapid recovery.

Decentralize or Die: Relying on a handful of validators or a single multisig is a recipe for disaster. Expand your validator set, but make sure they’re genuinely independent, not just different addresses controlled by the same party. Aim for geographic, organizational, and technical diversity. If you want to see how real-time monitoring and decentralized validators improve security, explore this case study.

Continuous Monitoring Matters: Static audits are snapshots in time. You need live monitoring tools like BridgeGuard or XChainWatcher to catch anomalies as they happen. These tools can alert you to suspicious validator actions, large withdrawals, or contract upgrades that could signal an exploit in progress.

Access Controls Are Non-Negotiable: Every critical function, pausing the bridge, upgrading contracts, moving funds, should have multi-layered access controls and clear, public documentation. Emergency powers should be transparent and time-locked, not hidden in backdoors or ambiguous admin roles.

Don’t Overlook Economic Security: Bridges are not just technical systems, they’re also economic ones. If your protocol’s wrapped assets can become unbacked due to a vault compromise, users will suffer, even if the contracts themselves are bug-free. Incentivize honest behavior and penalize malicious validators. Consider insurance or circuit breakers for catastrophic failures.

The Future of Cross-Chain Messaging: Building Trust Layer by Layer

The next generation of cross-chain protocols will be defined by how well they manage trust, not just in code, but in people, processes, and incentives. As the stakes get higher, it’s not enough to hope your bridge won’t be the next headline. Proactive, adversarial thinking and continuous improvement are the new normal for any serious project.

Want to dig deeper into real-world exploits and see how risk scanners are changing the game? Check out our research on why cross-chain bridges fail and how to prevent losses.

Ride the trend, respect the risk. In cross-chain, that means never taking trust assumptions for granted. The most resilient bridges are built by teams who question everything, audit relentlessly, and monitor constantly. That’s how you stay ahead of the next $4.3 billion disaster.