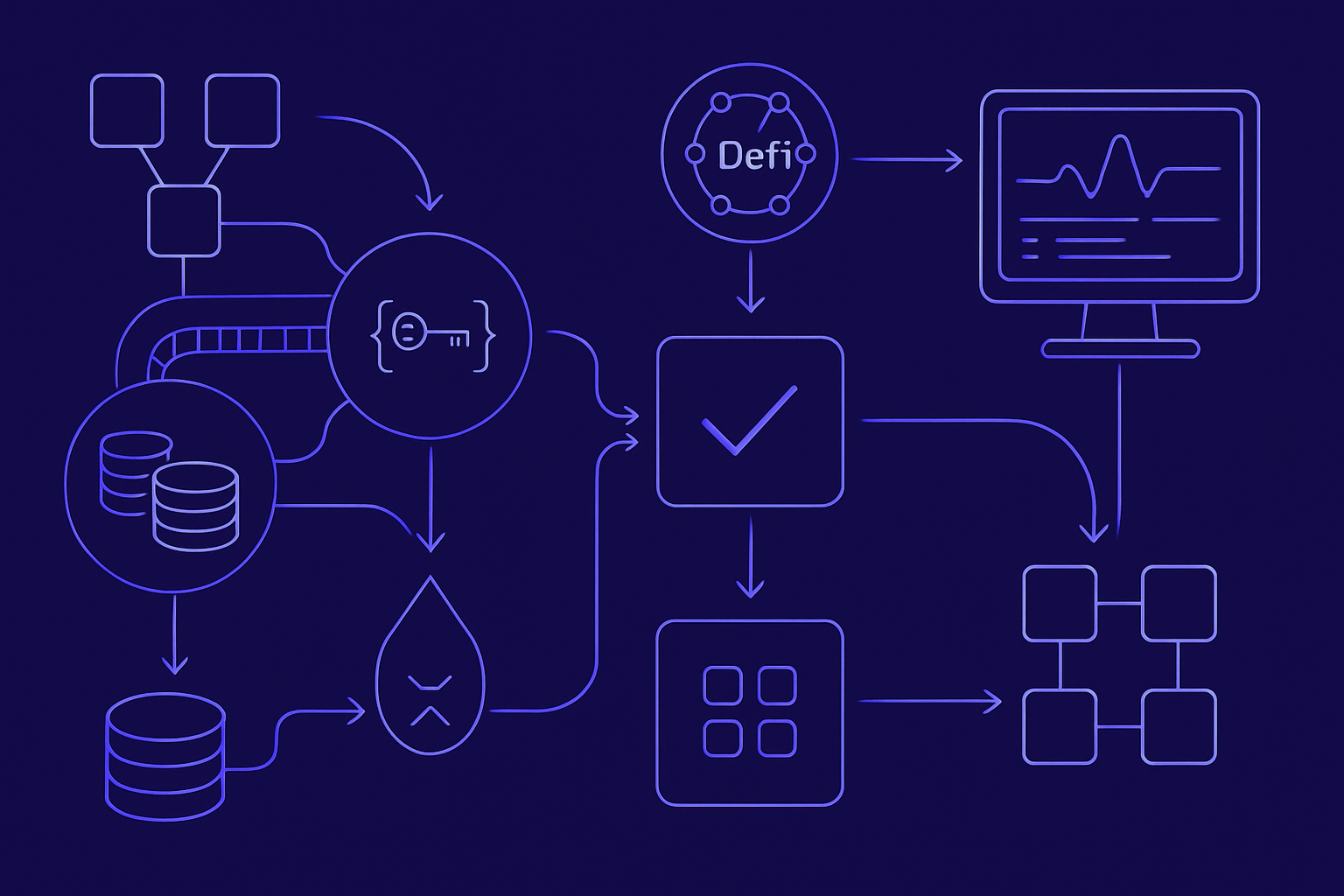

Cross-chain bridges are the connective tissue of decentralized finance, letting users move assets seamlessly between blockchains. But as DeFi expands, these bridges have become its most vulnerable point, an Achilles’ heel that attackers relentlessly target. In just the first half of 2025, bridge exploits and DeFi breaches have driven crypto losses to a staggering $2.17 billion by June, with cross-chain protocols at the epicenter of this crisis. The numbers are clear: bridges are being hacked at an unprecedented rate, and the sophistication of attacks is only accelerating.

Multisig Bridge Key Compromise: The Orbit Bridge Hack

One of the most critical vulnerabilities in today’s bridge architecture is the use of multisignature (multisig) key schemes to control cross-chain asset transfers. In theory, multisig wallets are designed to enhance security by requiring multiple parties to approve transactions. But in practice, if enough keys are compromised or collude, the whole system collapses.

The 2025 Orbit Bridge Hack is a sobering case study. Attackers managed to compromise several key holders in the multisig setup, bypassing all other controls and draining hundreds of millions in assets almost instantly. This incident not only caused immediate financial devastation but also sent shockwaves through the broader DeFi ecosystem, triggering liquidity panics and eroding trust in bridge-based protocols. The Orbit hack is a textbook example of cross-chain custody risk: when a small group controls access to billions in value, one breach can have catastrophic consequences.

Cross-Chain Message Validation Flaws: Poly Network 2.0 Exploit

Beyond key compromise, flaws in how bridges validate messages and transactions across chains remain a persistent threat. The Poly Network 2.0 Exploit in 2025 showcased the dangers of inadequate message validation logic. Attackers exploited a subtle bug in cross-chain message verification, allowing them to forge approvals and transfer assets they never owned.

This attack underscores the importance of robust message validation mechanisms and the perils of assuming that one chain’s logic will always translate securely to another. As bridges get more complex, so do the attack surfaces, making rigorous auditing and defensive design absolutely essential. For a deeper exploration of real-world exploits and modern mitigations, see our detailed analysis here.

Top 3 Cross-Chain Bridge Vulnerabilities & Solutions (2025)

-

Multisig Bridge Key Compromise: The 2025 Orbit Bridge HackIn January 2025, the Orbit Bridge suffered a devastating attack when hackers compromised its multisignature wallet keys, resulting in over $80 million in stolen assets. This breach highlighted the risks of concentrated key ownership and insufficient key management protocols. Actionable Security Measure: Implement threshold signature schemes and secure, distributed key management to minimize single points of failure.

-

Cross-Chain Message Validation Flaws: Poly Network 2.0 ExploitThe Poly Network 2.0 exploit in July 2025 exposed critical flaws in cross-chain message validation, allowing attackers to forge messages and drain assets. This incident echoed the original 2021 Poly Network hack but leveraged new vulnerabilities in upgraded protocols.Actionable Security Measure: Enforce rigorous, multi-layered message validation and conduct comprehensive smart contract audits to detect and patch vulnerabilities before deployment.

-

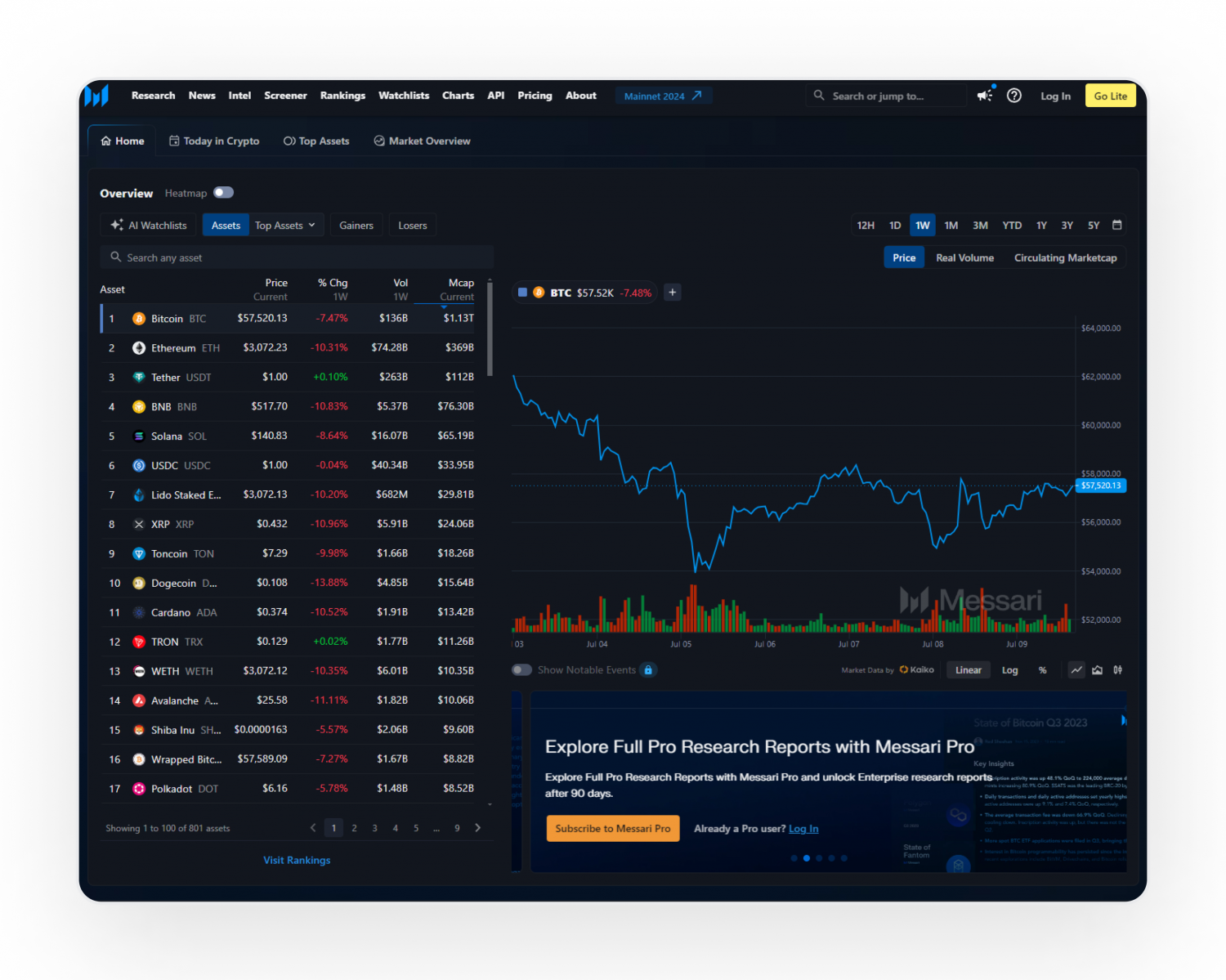

Real-Time Transaction Monitoring and Automated Risk Scanning as a Prevention StrategyLeading DeFi institutions now deploy real-time transaction monitoring and automated risk scanning tools to identify suspicious activity and halt exploits in progress. Solutions like Chainalysis and Merkle Science offer advanced analytics to detect anomalies across cross-chain bridges.Actionable Security Measure: Integrate continuous monitoring and automated threat detection systems to proactively defend against evolving bridge exploits.

Real-Time Transaction Monitoring and Automated Risk Scanning: Prevention in Action

Given the scale and speed of attacks in 2025, static audits alone aren’t enough. The next frontier in bridge security is real-time transaction monitoring combined with automated risk scanning. These systems analyze every transaction as it happens, flagging anomalies, suspicious patterns, or unauthorized key usage before attackers can drain funds.

By integrating automated scanners and on-chain analytics tools directly into bridge infrastructure, developers and institutions can catch exploits in progress and trigger rapid response measures. This proactive approach is already making waves: some projects have managed to halt attempted exploits mid-flight, dramatically reducing losses and restoring user confidence. For more on how real-time monitoring is reshaping bridge security, check out this guide on modern risk scanning.

Of course, implementing these advanced monitoring systems is not a silver bullet. Attackers are constantly evolving, and every new security measure can trigger a new class of exploits. However, the difference in outcomes is stark: protocols with real-time scanning and robust alert systems are consistently seeing lower losses and faster recoveries than those relying solely on periodic audits or reactive patching. The trend is clear, dynamic, ongoing risk assessment is now a baseline requirement for any bridge handling substantial value.

For DeFi developers, this means integrating automated risk scanners at every layer of their cross-chain architecture. From transaction pre-processing to post-execution analytics, every data point is an opportunity to spot malicious activity before it escalates. Security teams should also prioritize collaborative intelligence sharing, when a new exploit is detected, rapid dissemination of threat signatures across the ecosystem can help others shore up defenses in real time.

What Developers and Institutions Must Do Next

If you’re responsible for a bridge or a DeFi protocol that depends on cross-chain messaging, the takeaways from 2025’s loss statistics are urgent:

- Audit multisig key management: Rotate keys regularly, use hardware security modules, and monitor for unusual keyholder activity.

- Harden message validation logic: Employ formal verification, fuzz testing, and cross-chain simulation to uncover subtle bugs before attackers do.

- Adopt continuous risk scanning: Leverage real-time analytics, anomaly detection, and automated incident response to stay ahead of emerging threats.

Institutions entering DeFi must also demand transparency from bridge providers. Ask for detailed disclosures on validator decentralization, key management practices, and incident response protocols. The days of trusting black-box bridges are over; only those with demonstrable, ongoing security practices will earn user trust in the years ahead. For a comprehensive breakdown of top vulnerabilities and how risk scanners prevent losses, see this resource on attack vectors and prevention.

Looking Ahead: Building a Safer Cross-Chain Future

The events of 2025 have made it clear that cross-chain bridge security is not just a technical challenge, it’s an existential one for DeFi as a whole. With $2.17 billion lost by June and high-profile incidents like the Orbit Bridge hack and Poly Network 2.0 exploit, the stakes have never been higher. But the path forward is also clearer than ever: layered security, continuous monitoring, and open collaboration are now the foundation stones for resilient, scalable DeFi infrastructure.

Ultimately, the most secure bridges will be those that treat security as an ongoing process, not a checkbox. By learning from the latest exploits, investing in automated risk scanning, and demanding transparency at every step, developers and institutions can help DeFi realize its promise, without repeating the costly mistakes of the past.