Cross-chain messaging protocols are the backbone of blockchain interoperability, enabling seamless movement of assets and data between disparate networks. However, as these protocols become more critical to the Web3 ecosystem, they also present an expanding attack surface for malicious actors. In 2024 alone, security incidents targeting cross-chain infrastructure contributed to losses exceeding $2.9 billion across DeFi, CeFi, gaming, and metaverse platforms (Hacken 2024 Web3 Security Report). The pace and sophistication of these attacks underscore the urgent need for robust risk assessment tools and proactive defense strategies.

Escalating Threats: High-Profile Bridge Exploits Signal Systemic Risk

The past two years have been marked by a series of devastating cross-chain bridge hacks that exposed systemic weaknesses in protocol design and validator governance. The Ronin Bridge hack in March 2022 remains one of the most infamous events, where attackers leveraged compromised validator private keys to siphon off nearly $600 million in USDC and ETH (turnkey.com). Similarly, vulnerabilities in the Wormhole bridge’s smart contract logic enabled unauthorized token minting and a loss of $326 million, while flaws in Nomad’s protocol led to an opportunistic drain worth $190 million.

The attack on BNB Chain’s bridge further illustrated how manipulation of message verification systems can result in catastrophic financial consequences, here, approximately $137 million was lost due to inadequate safeguards against fraudulent cross-chain messages (medium.com). These incidents are not isolated; they reveal persistent architectural weaknesses that adversaries continue to exploit.

Anatomy of Cross-Chain Messaging Vulnerabilities

To understand why these attacks are so effective, it’s essential to dissect the common vulnerabilities afflicting cross-chain messaging protocols:

Key Vulnerabilities in Cross-Chain Messaging Protocols

-

Validator Compromise: Attackers who gain control over a majority of bridge validators can authorize fraudulent cross-chain transactions, as seen in the Ronin Bridge hack where nearly $600 million was stolen.

-

Smart Contract Bugs: Complex cross-chain protocols often contain subtle flaws in their smart contracts. Exploits like the Wormhole Bridge exploit resulted in $326 million in losses due to a single code vulnerability.

-

Replay Attacks: Insufficient nonce management or message uniqueness can allow attackers to replay legitimate cross-chain messages, executing unauthorized actions multiple times and draining assets.

-

Economic Incentive Misalignment: If the cost to compromise a protocol (e.g., bribing or attacking validators) is lower than the potential reward, bridges become prime targets for economic attacks, as highlighted in several 2024 security reports.

- Validator Compromise: Bridges often depend on a set of validators to authorize transactions across chains. If attackers gain control over enough validators, whether through social engineering or direct exploitation, the entire bridge can be commandeered for unauthorized withdrawals.

- Smart Contract Bugs: The intricate logic required for interoperability increases the probability of exploitable flaws. Even minor oversights can enable attackers to manipulate contract state or bypass authentication checks.

- Replay Attacks: Inadequate nonce management allows adversaries to reuse valid messages across transactions, executing unauthorized actions multiple times until detected.

- Economic Vulnerabilities: When attacking a bridge is cheaper than its total locked value (TVL), rational adversaries are incentivized to strike. Weak incentive alignment exposes protocols to both technical and economic exploits.

The cumulative effect is stark: since May 2021, over $3.2 billion has been stolen from cross-chain bridges (arxiv.org). These losses not only impact token holders but also erode trust in Web3’s foundational promise, secure digital asset ownership and transferability.

User Data at Risk: Beyond Financial Losses

The repercussions extend far beyond immediate monetary theft. Many attacks on cross-chain infrastructure expose sensitive user data, wallet addresses, transaction histories, even private keys if key management is weak. Such breaches open doors to targeted phishing campaigns and identity theft risks within decentralized ecosystems.

The cycle is self-reinforcing: each successful exploit further undermines confidence in emerging interoperability solutions like Wormhole or LayerZero (blaize.tech). As fragmentation persists across chains and bridges proliferate without standardized security frameworks, users face mounting uncertainty about where their assets, and their data, are truly safe.

Mitigating these cross-chain messaging vulnerabilities requires a multifaceted approach, blending technical rigor with economic game theory and operational best practices. The most resilient protocols today are those that treat security as an ongoing process, not a one-time audit checkbox.

Strengthening Cross-Chain Security: Best Practices and Emerging Solutions

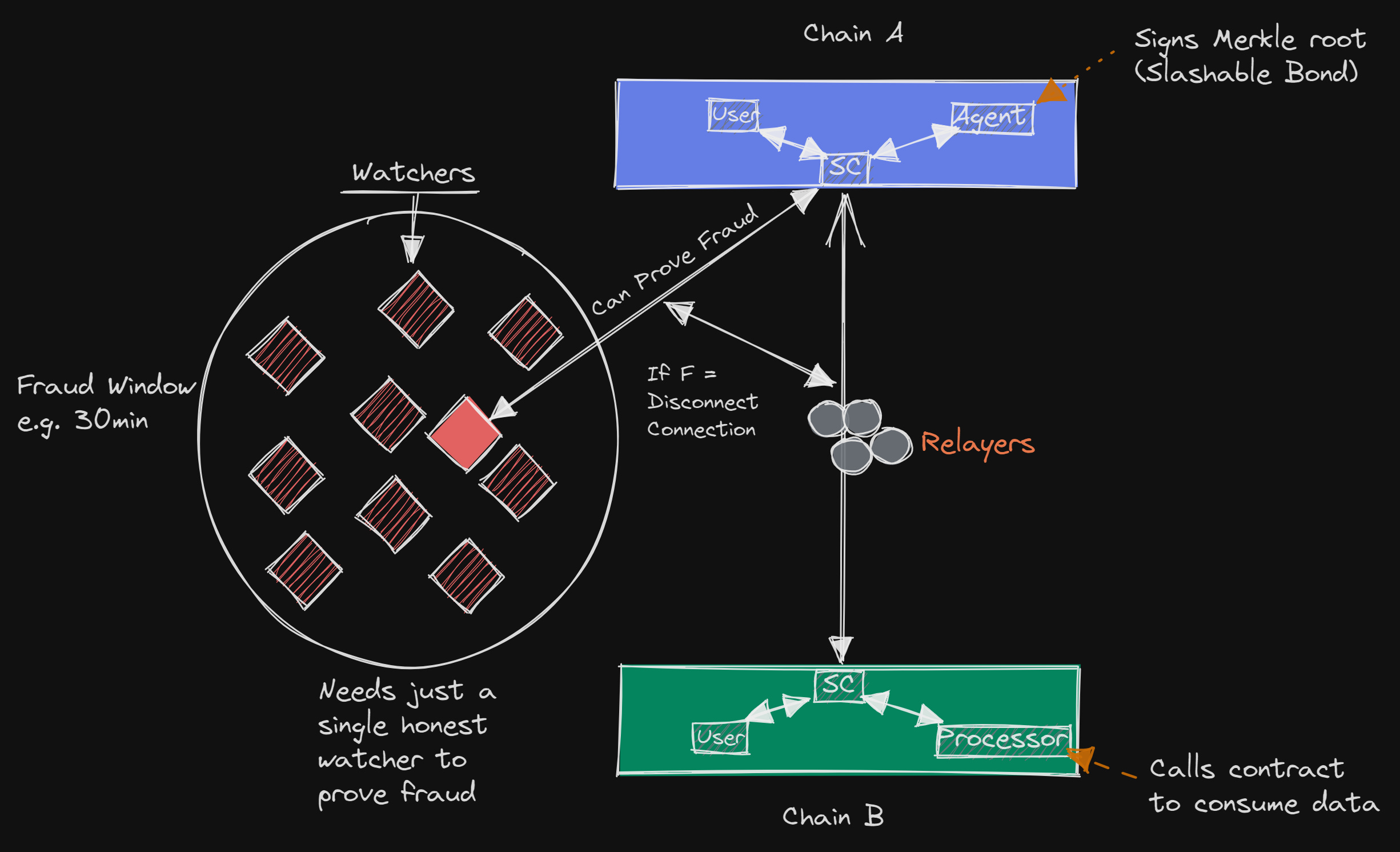

Protocol teams are increasingly prioritizing the decentralization of validator sets, leveraging threshold cryptography and multi-party computation to minimize single points of failure. For example, bridges that implement robust key management schemes, such as hardware security modules or distributed key generation, significantly reduce the risk of validator compromise. Formal verification of smart contracts is gaining momentum, with advanced static analysis tools surfacing logic flaws before code hits mainnet (university.mitosis.org).

Economic incentive alignment is another critical vector. Protocols must ensure that the cost to attack always exceeds potential rewards, often by requiring substantial collateral or implementing slashing mechanisms for malicious validators (university.mitosis.org). However, as recent exploits demonstrate, no system is infallible, continuous monitoring and rapid incident response are essential.

The proliferation of cross-chain risk scanners represents a major leap forward for real-time threat detection. These platforms aggregate on-chain data, monitor validator behavior, and flag anomalous transactions before they escalate into systemic breaches. Developers and users alike should leverage such tools to assess protocol health and make informed decisions about bridge usage.

The Road Ahead: Toward Secure Interoperability

The cross-chain ecosystem remains in flux. While 2024’s record-breaking losses, over $2.9 billion, per Hacken, have galvanized the industry’s focus on security, fragmentation persists across standards and implementations (Hacken 2024 Web3 Security Report). Chain abstraction and unified messaging layers are promising developments but introduce new dependencies that must be scrutinized through both technical audits and economic modeling (blaize.tech).

User education remains paramount. As attackers pivot tactics, from contract exploits to social engineering, the burden falls on both protocol teams and end users to remain vigilant. Adopting best practices such as non-custodial wallets, multi-factor authentication for validators, and regular review of protocol audits can substantially reduce exposure.

The future of Web3 hinges on secure interoperability. By combining decentralized architecture with rigorous formal verification, real-time risk scanning, and robust incentive design, the community can begin to restore trust in cross-chain infrastructure, and protect both user data and digital assets from evolving threats.